Taxman Admits Error Over Social Charges

Friday 15 April 2011

A couple who were wrongly assessed for social charges have been granted a full rebate.... with a bit of help from us.

Just how many of you are paying social charges when you should not be doing so we do not know, but we get a regular flow of mails into the office from readers querying the social charges imposed upon them.

The ‘social charges’ are known as the prélèvement sociaux, comprising three different taxes:

- Contribution Sociale Généralisée (CSG)

- Contribution au Remboursement de la Dette Sociale (CRDS)

- Prélèvement Social (PS)

These charges are not payable on the retirement pensions of those of retirement age from the EU by virtue of the fact that their health cover is arranged through an E121/S1.

Indeed, early retirees are also exempt on their pension income if they hold health cover through an E101/S1.

Nevertheless, many local tax offices in France are not aware of the right of exemption of those on an ‘E’ form (or may not have seen a copy), as a result of which they impose the charges.

John and Joyce Bennett are two English septuagenarians who have lived in Anost, Burgundy since 2004.

Over the past two years the social charge ‘CRDS’ has been imposed on their pension, resulting in several hundred euros in taxes in each year.

When John and Joyce complained to their local tax office about the charges, they were advised that because they were affiliated to the French health system through the local health authority, the CPAM, they were liable.

In fact, the CPAM’s merely act as agents in the administration of the E forms, in the same way the health authorities in the UK and other EU states act as agents for French nationals on an E form living in another EU country.

Accordingly, we advised John and Joyce to take their case to the Conciliateur Fiscal, the ombudsman for tax matters in France. Each department of France has its own Conciliateur Fiscal.

As part of the preparatory work for presenting their case, John and Joyce needed to obtain a copy of their E121, which they had deposited with their CPAM in 2004. They were initially advised that all such documents were destroyed after two years, and so it could not be provided.

So they sought a duplicate form from the Pensions Office in Newcastle, which arrived within several days. A copy of their original E121 from their CPAM also coincidentally arrived the same day!

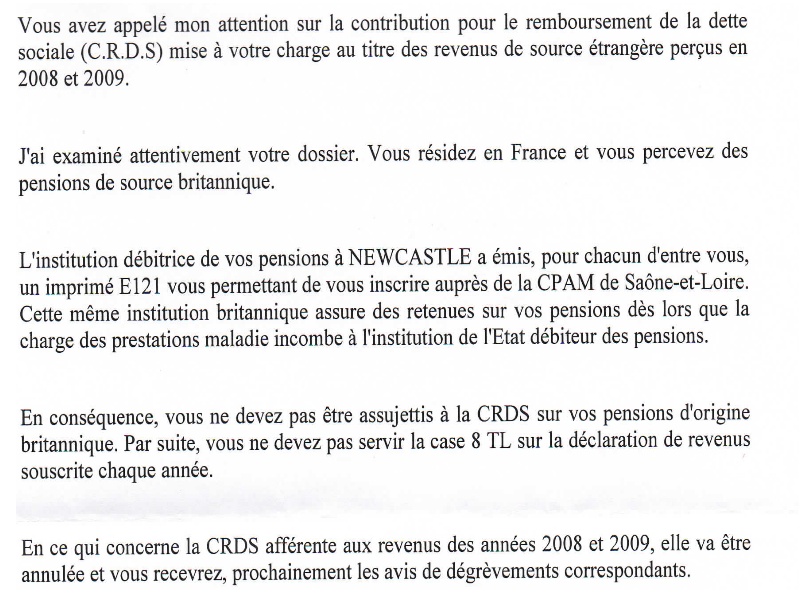

Within a matter of weeks of submitting their grievance they received a reply from the Conciliateur Fiscal, which confirmed what we had advised them.

As a result, the couple were granted a refund in full of the social charges they had paid in 2008 and 2009.

It is worth publishing the reply they received, as others of you may be able to benefit from it.

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.