Sterling/Euro Currency Review March 2015

Friday 03 April 2015

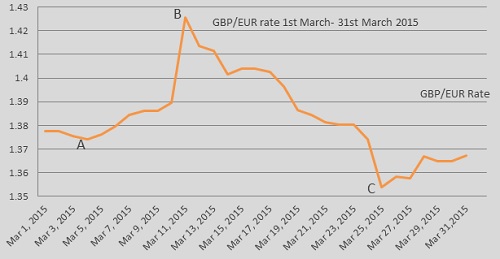

March was a tale of two halves for Sterling, with initial impressive gains, followed by a later reversal of fortune, says Ben Scott.

Sterling reached fresh seven-year highs of 1.4255 (Interbank throughout), later losing over 5% against the euro in just two weeks reaching a low of 1.3540, trading at an average rate of 1.3835 throughout March.

The euro was boosted as concerns surrounding a Greek debt default and doubts regarding the European Central Bank quantitative easing (QE) programme subsided.

Meanwhile the threat of deflation in the UK weighed heavily on the pound, as the potential of a Bank of England (BOE) rate cut grew.

Sterling gains in early March appear to be a result of euro concerns as opposed to any standout improvements in the UK economy.

The first few weeks of March saw the euro continue to depreciate in quite remarkable fashion as illustrated from point A on the graph.

Despite the immediate risk of Greece exiting the eurozone, ‘Grexit’ being eased by the announcement of the four-month extension to Greek aid package towards the end of February, tensions between Germany and Greece continued to weigh on the euro. Michael Fuchs who is a member of the Christian Democratic Party CDU) in Germany illustrated this with his comment , by stating, “Greek exit from the euro could be managed”.

This comment fuelled concerns that the four-month extension granted to Greece was merely a case of ‘delaying the inevitable’ with regards to Greece eventually defaulting on their unmanageable debt obligations. This would result in Greece being forced to leave the Eurozone, almost certainly leading to a weaker the euro on fears of contagion for peripheral European countries.

Euro weakness grew with concerns about just how effective the ECB QE programme would prove, fears which were exacerbated by doubts from Vice President of the European Central Bank, Vitor Constancio, who stated, “one of the factors the ECB is still unsure about is whether there are enough people willing to sell bonds in large amounts to allow QE to work”.

If there are not enough sellers of bonds, the QE program will fail and this would prove extremely detrimental to the euro with the ECB having no real weapons left to fight deflation or stimulate economic growth.

Sterling losses from point B can predominantly be attributed to concerns surrounding the very real prospect of the UK slipping into deflation, a concern highlighted by Bank of England Governor, Mark Carney, when addressing the House of Lords on 10 March. Governor Carney reiterated previous concerns in saying, “inflation [is] likely to fall to around zero in coming months”. This increased speculation that the BOE would cut interest rates even lower than the current low of 0.5%, where interest rates have remained since being cut to this level in March 2009.

Sterling weakened to a month-low on March 24th on the announcement that inflation in the UK had indeed fallen to zero (well ahead of initial BOE forecasts for such a level). It now seems entirely plausible that the Bank of England will cut interest rates to fight the threat of deflation over the next few months. With an interest rate cut generally recognised as being negative for a currency as investors leave the currency in search of better returns elsewhere, Sterling looks set to remain under significant pressure.

Outlook

UK economic improvement continues, although at a slightly slower pace than previously seen. Final Q4 2014 UK GDP data released at the end of March showed the UK economy grew by 0.6% in the final quarter of 2014 against an expected level of 0.5%. This indicated that economic growth in the UK did slow towards the end of the year, but did not as much as previously anticipated.

With the UK now firmly in ‘election season’, pressure on sterling is likely to continue as elections (especially close fought elections) historically lead to uncertainty for business with investors likely to seek more secure investments elsewhere, therefore weakening the pound.

It remains unclear whether recent euro strength represents a change in sentiment towards the single currency, which has endure a dire start to 2015 or if recent improvement is merely a short-term correction.

Economic data from Germany throughout March supports the view that quantitative easing may already be having a positive impact on the economic performance of the Eurozone, with improvements in manufacturing and services PMI data, business climate readings and consumer confidence data. Economic improvements, if continued, will almost certainly add to euro strength.

A meeting towards the end of March, between German Chancellor Angela Merkel and Greek Prime Minister Alexis Tsipras, aimed at building bridges and discussing potential resolutions for dealing with the Greek debt crisis were described as positive.

However, no definitive plans were agreed and concerns grow, once more, that without fresh aid Greece is set to run out of money by 20 April. Such a scenario would mean Greece would no longer be able to service its significant debt obligations, again raising the very real prospect that Greece would be forced to leave the European Union. Such a ‘Grexit’ would weigh heavily on the euro.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: Second Homes Tax Exemption

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.