Quarterly Sterling/Euro Currency Review - Q2/10

Thursday 15 July 2010

Sterling performed significantly better in the second quarter of 2010 than at any stage since the onset of the economic downturn in August 2007, writes Ben Scott.

In the period Sterling experienced an increase of approximately 12 cents against the Euro.

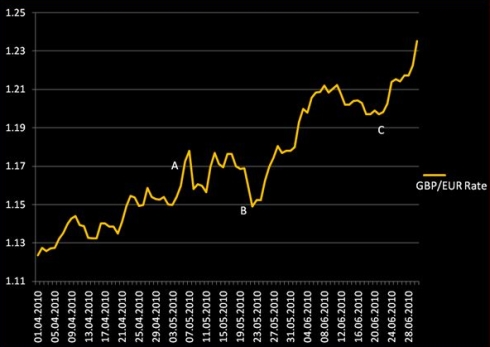

GBP/EUR exchange rate hit a high of 1.2391 (interbank) towards the end of June from a low of 1.1176 (interbank) at the start of April as illustrated by the graph below.

The average GBP/EUR exchange rate for Q1 of 2010 was 1.1273; it was 1.1706 for the Q2 of 2010 an average increase of over 4 cents in favour of the pound throughout Q2 of 2010 compared to Q1 of 2010.

The significant improvement of Sterling’s fortunes can be attributed to a combination of slight improvements in the economic outlook for the UK at the start of Q2, but more meaningfully to the Euro-Zone debt crisis which undermined the global economic recovery.

The debt crisis which has gripped Greece during this period saw its debt credit rating cut to ‘Junk’ by Standard & Poor’s Credit Agency on April 27th, leading to the implementation of a combined €110billion emergency loan announced on the 2nd May to ensure Greece’s debts did not freefall into default.

This stunned financial markets and saw the onset of rapid depreciation of the Euro against Sterling, as illustrated by point A on the graph above.

The relatively sharp pullback immediately after point A and the following uncertainty until point B on the graph was a direct consequent of the UK’s general election on the 6th of May, resulting in the first hung parliament since 1974.

The subsequent ‘horse-trading’ between the Liberal Democrats and the Conservatives lead to a LIBCON coalition government, but caused wide spread concern that a coalition government in the UK would not be able to deal with the spiralling budget deficit, forcing Sterling to weaken.

The striking improvement of Sterling’s fortunes from the 22nd June (Point C on the graph) was a direct result of what the currency markets perceived to be an extremely positive Emergency Budget from Chancellor George Osborne.

Despite highlighting the savage cuts to the UK economy, the budget did satisfy credit rating agencies that the UK would be able to slash its record deficit, thereby preserving the UK’s revered 'AAA' credit rating for the foreseeable future and so pushing Sterling higher.

Outlook

Going forward, numerous factors will dictate the direction of GBP/EUR exchange rate over the coming months, with the economic outlook for both the UK and the Euro-zone deteriorating towards the end of Q2, making any meaningful forecasts difficult to come by.

German Chancellor Angela Merkel stated on 19th May that, “the Euro is in danger”, while continuous rumours suggested one or many of the single currency countries are looking to remove themselves from the Euro in a bid to avoid economic meltdown, showing there is potential for GBP/EURO rates to push higher as the Euro is hit as a result of growing uncertainty.

Speculation continues to grow that Portugal and Hungary are set to experience similar financial crisis to that seen in Greece over recent months and with Fitch credit rating agency cutting Spain’s 'AAA' credit rating to 'AA+' there are numerous indications that the financial crisis could engulf any of the notorious 'PIIGS' (Portugal, Ireland, Italy, Greece and Spain) directly.

Given an anticipation of further interest rate cuts from the European Central Bank, as well as concerns about potential loses for German and Spanish banking systems, and the risk of default on European debts, it is hard to feel optimistic about the future of the Euro.

On the other hand a faltering economic recovery in the UK illustrated by deteriorating factory output, stalling house prices, and indications that banks are set to tighten lending further suggest potential Sterling weakness.

This, combined with suggestions that the recent austerity budget was too savage and will actually handicap what is already a fragile economic recovery, have lead many financial experts to suggest that the chances of a dreaded 'double dip' recession are now ‘very possible’, indicating Sterling weakness is a very real possibility.

Ben Scott,

Foreign Exchange Ltd

www.fcexchange.co.uk

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.