Sterling/Euro Currency Review Q1 2012

Thursday 05 April 2012

Sterling traded in a narrow range against the euro in the first quarter, and failed again to take advantage of continuing difficulties in the Eurozone, writes Ben Scott.

Despite starting positively against the euro in January, momentum was lost as fears of a double-dip recession once more gripped the UK markets, negating the potential of further gains.

The euro suffered from its relentless debt problems, whilst continuing to struggle with the threat of eurozone debt contagion.

Sterling touched a sixteen month high of €1.2123 (Interbank) in January before touching a low of €1.1782 in the last week of February. It finally averaged a Q1/2012 rate of €1.1981.

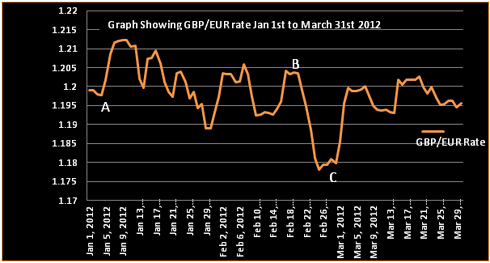

The graph below illustrates the continued cause for concern for euro buyers, as Sterling proved unable to capitalise on gains against a distressed euro.

The sharp rise in the GBP/EUR after Point A on the graph came despite Sterling’s demise against most of its trading partners.

At a time when Sterling made significant losses against the US$, AUS$ and NZ$, it is evident that GBP/EUR increases were more a result of euro weakness and on-going debt concerns rather than any sustainable Sterling strength.

The pound was able to make robust gains through €1.20, despite mediocre economic data, as debt concerns continued to engulf Greece, Portugal and Spain; the International Monetary Fund (IMF) admitted it was “losing confidence in Greece to work off it's mountain of debt”.

Further, concerns that Germany (EU’s main growth contributor) stood on the brink of a recession, resulted in several European countries, (including Germany and Spain) failing to complete successful bond auctions – shockwaves felt through the financial markets as investors expressed concerns in the European countries’ ability to fulfil their debt obligations.

Citibank added to euro woes by forecasting a further 0.5% interest rate cut from the European Central Bank (ECB) by June 2012, leading Fitch, the credit rating agency, to warn of the “possible worsening of Europe’s debt crisis and potential disintegration of the eurozone”.

Yet again Sterling failed to retain gains, falling below €1.20 in mid-January as economic data in the UK triggered concerns that it too faced another recession. Retail sales fell, consumer confidence diminished, whilst UK unemployment hurtled to a 17 year high (8.4%). Gross Domestic Production (GDP) figures showed the UK economy contracted -0.2% in Q4 2011; two consecutive months of contraction officially represents a recession.

Despite comments at this time from the ECB President, Mario Draghi, that there were “tentative signs of stabilisation of euro economy”, credit rating agency Standard & Poor’s decision to cut France’s prestigious AAA credit rating, and subjecting Italy and Spain to credit downgrades, increased borrowing costs for European countries. Significantly, they emphasised the economic concerns and lack of political harmony which continued to engulf the eurozone. Sterling’s failure to take advantage here highlights the underlying weakness of the UK economy.

Going into February Sterling was able to reclaim some ground lost to the euro as the relentless Greek debt crisis once again crawled towards conclusion and talk of agreement, repeatedly followed by the disappointment of failed negotiations.

Greece’s inability to agree a ‘haircut’ with private creditors on the outstanding debt burden put in jeopardy a vital second bailout of €130 billion; fear then mounting that if a solution was not agreed that Greece would default on its debt obligations and be forced to leave the euro, which would almost certainly send the euro into free-fall.

Pound weakness, early February to Point B on the graph, came about after ECB President, Mario Draghi, commented that he had personally received a call from Greek Prime Minister, Lucas Papademos, confirming that a deal on the passing of new austerity measures had been reached. Although reducing the risk of default and strengthening the euro, this statement again proved to be premature.

However, a double blow was the more significant catalyst for Sterling weakness. The Bank of England (BoE) announced an additional £50 billion quantitative easing (QE) to the £275 billion fiscal stimulus already injected into the economy, and there was a surprise announcement from credit rating agency, Moody’s, to place the UK’s revered AAA credit rating on a negative outlook. The agency further stated that there was a one in three chance that the UK would lose this rating within 18 months.

Greece’s announcement that their economy had shrunk a massive 7% in Q4 2011 pushed GBP/EUR higher, leading to Point B on the graph.

All rates are quoted as interbank rates.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Back To: French News

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.