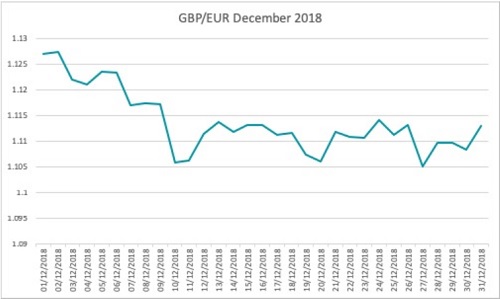

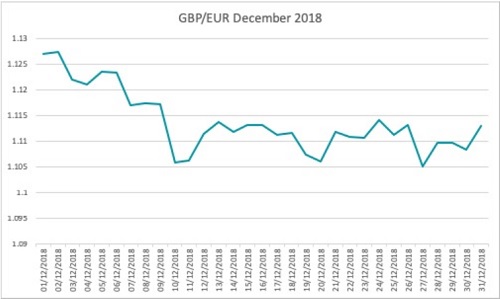

Sterling began the month at levels of €1.12 versus the Euro (GBP/EUR), but it sank to €.10 last month, writes Ben Scott of Global Reach.

Sterling slipped on December 3rd, despite a lift in UK manufacturing activity. However, when investors looked closely at the data produced by Markit, it revealed the Manufacturing Purchasing Managers’ Index (PMI) increased from 51.11 to 53.1 in November due to companies stockpiling products in case Brexit caused trade disruption.

The data also showed a contraction in new orders from international parties for the second month running, marking the first consecutive months of contraction since 2016. Markit Director Rob Dobson commented: ‘Brexit worries also increasingly dominated the outlook for the sector. Although still forecasting growth for the year ahead, manufacturers’ confidence fell to its lowest ebb since August 2016.’

Meanwhile, it wasn’t good news for the Eurozone’s manufacturing sector either. The Eurozone noted a decline from 52.0 to 51.8 in its own PMI and registered the weakest growth since 2016. Italy’s manufacturing sector contracted, while France registered a 26-month low with a very slight expansion.

By December 5th Sterling was trading lower across the board, reaching a 17-month low against the US Dollar (GBP/USD) as Brexit debates raged on.

On the 10th December, Sterling put in a dreadful performance, extending losses against the US Dollar to reach a 20-month low, and hitting a three-month low against the Euro.

The downturn in Sterling came after British Prime Minister Theresa May announced that the vote on her Brexit agreement would not take place on the 11th December as planned as it would most likely be defeated. The PM decided to postpone the vote in a bid to gain more time to speak to the EU and reach some reassurances over the Irish backstop issue which has been one of the most problematic aspects of negotiations.

The vote has now been scheduled for the week commencing January 14th and is expected to create significant GBP volatility.

Some good news came in the form of wage data in December; the UK’s Average Weekly Earnings stat jumped in the three months through October on the year, hitting 3.3%, a 10-year high. The wage figure was the best on record since the Global Financial Crisis and offered some comfort to households against a backdrop of Brexit chaos. Inflation resided at 2.2% in October, so the wage increase offered UK citizens a boost in household finances.

However, it wasn’t long before the Pound came under political pressure again, this time in the form of a vote of no confidence in Theresa May. On the 13th December, Sterling was recovering from the ballot after Theresa May secured a victory, winning by 83 votes.

Meanwhile, the European Central Bank (ECB) stood by its decision to end its quantitative easing programme which had been in place for almost four years.

Economist Patrice Gautry commented: ‘

The ECB is looking at an increasingly risky environment and is forecasting sluggish growth (under 2.0%) in the coming years, along with persistently sub-2.0% inflation until 2021. However, it is winding up its quantitative easing programme, as previously announced.’

Investor attention has been frequently focused on the political disruption posed by Italy in recent months after Rome went head to head with the EU over its budget.

The end of December brought with it news that Italy’s parliament had approved a revised budget for 2019. Italy had little choice but to review its budget after warnings that it could face fines or disciplinary action.

An agreement with the European Commission was reached, which saw Italy revise its budget deficit to 2.05% of Gross Domestic Product (GDP) rather than maintain the previous 2.4% plan.

As the Christmas break approached, German business sentiment marked a decline to its lowest level in two years.

The German IFO Business Climate number hit 101.0 in December, a fall from November’s 102.0. The Expectations index fell to 97.3 from 98.7, and the Current Assessment index tumbled to 104.7 from 105.4.

Further indications of a slowdown in the Eurozone’s largest economy will likely gain the attention of economists and investors in the Euro. IFO President Clemens Fuest said: ‘We think it’s a permanent slowdown. Not a downturn, we still expect growth next year.’

In coming months, politics are likely to steal the limelight, with a vote on Theresa May’s Brexit proposal approaching and the official March 2019 Brexit day just around the corner.

Political concerns have meant that gains for Sterling in recent months have been short-lived, and with deadlines and the potential for further disruption ahead, the British currency could lose its appeal with many investors.

Meanwhile, the Euro has political concerns of its own with European elections coming up in the spring. Economists will also be paying close attention to economic data now that the European Central Bank has halted its stimulus measures. Any further slowdowns in growth could raise concerns about the health of the currency bloc, which may not offer any support to the EUR exchange rate.

Ben Scott

Global Reach

Related Reading: