Vineyard Prices in France 2013

Wednesday 02 July 2014

Vineyard prices rose by an average of 1.5% in 2013, but it was a very mixed year in which few generalisations are possible.

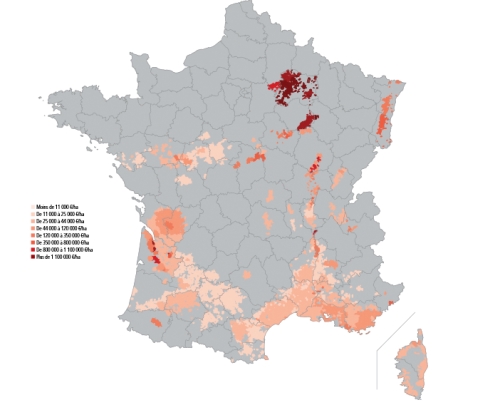

There are enormous divergences in vineyard prices in France.

Even at a regional level, such are the variations between different appellations and classifications that buyers have to undertake their market research with great care.

It is the same for the performance of the market, for all that can be broadly stated was that it was a mixed year for the wine growing areas of France: whilst some vineyards showed an upward trend, many went south.

Outside of Champagne, AOP vineyards (formerly Appellation d’Origine Contrôlée - AOC) rose by an average of 1.5% last year, to reach an average of €59,600 per hectare.

According to SAFER, (Société d'aménagement foncier et d'établissement rural) prices have picked up in recent years due to low interest rates and increased revenues from wine production, due to the rise in global demand, particularly from the leading producers in Bordeaux and Burgundy.

The following table shows the average sales price per hectare, with the variation from 2012, for AOP vineyards in each of the main wine areas of France.

| French AOP Vineyard Prices 2013 | ||

| Region | Price €/HA | Variation 12/13 |

| Alsace-East | €126,200 | -9.8% |

| Bordeaux-Aquitaine | €82,800 | +1.0% |

| Burgundy-Beaujolais-Savoie-Jura | €141,900 | +4.7% |

| Champagne | €1,077,400 | -1% |

| Corsica | €17,900 | +2.3% |

| Languedoc-Roussillon | €11,700 | -0.8% |

| South-West | €13,700 | +1.5% |

| Val-de-Loire-Centre | €28,100 | +1.4% |

| Rhone Valley-Provence | €38,900 | +3.7% |

| France AOP | €131,600 | -0.1% |

| France AOP (ex Champagne) | 59,600 | +1.5% |

Source: SAFER

Vineyards outside of this classification with no geographic indication (IOP) also saw a positive growth of an average of 1.7% to reach €12, 100 per hectare. This is the third consecutive year when average prices for such vineyards have increased, after a decade between 2000 and 2010 when prices fell by an average of 28%.

The change in fortunes is for the most part attributable to the restructuring and resurgence of the vineyards of Languedoc. Over the past 30 years, there has been a dramatic reduction on the surface area dedicated to vineyards in this region, which has shrunk from 407,000 hectares in 1979 to 236,000 today. The reduction in vineyards has been accompanied with a change in the varietals grown, with a large fall in Carignan production, replaced by Syrah, Grenache and Merlot varieties, which are also produced in lower densities.

Drill down into the figures and the magnitude of the differences that 'average' prices can hide becomes apparent.

Thus, in Alsace, prices per hectare range between €40K and over €300K, in a market where there is not a lot of sales activity.

In Bordeaux, highest prices for vineyards are in the Paulliac appellation at an average price of €2 million a hectare, followed by Saint-Julien-Margaux at €1m/ha, and Pomerol at €900K/ha. By contrast, more down to earth prices can be found for Bergerac (€10k/ha), Bordeaux rouge (€15K/ha), or Cotes de Marmandais (€9K/ha), but where the profitability of such vineyards is much more uncertain.

In Burgundy, vineyards of the Bourgogne Grand Cru reach stratospheric prices at €3.8 million/ha, the highest priced vineyards in France. Lower classed Bourgogne Premier Cru sells at €500K/ha and Bourgogne Rouge at €32K/ha. The cheapest Beaujolais vineyards average around €10/ha, although starting prices are lower. There has been a substantial reduction in the surface area of such vineyards in the last few years, down from 17,000 to 11,500 hectares.

Vineyards in Champagne sell for anything between €800K/ha and €1.6m/ha, although once again, the starting prices of some vineyards are considerably lower.

In the vast Languedoc-Roussillon region vineyard prices are far more modest, but equally varied, ranging from €10K/ha up to €37K/ha for vines of Pic Saint-loup in the Herault department. IOP vineyard prices will be lower. In the adjoining Pyrénées-Orientales, the sweet wines of this area continue to suffer from a surprising lack of customer demand, with average prices for the vineyards flagging at between €9K/ha and €22K/ha.

Market activity in the South-West is very small, and vineyard prices are amongst the lowest in France, starting at €5K/ha at the bottom in many areas, up to around €45K/ha for the vineyards of the lovely white wines of Jurançon. The vineyards of Marcillac in Aveyron fell by 33% in the year, down from €30K/ha to €20K/ha.

In the Loire, many vineyards can be purchase for well under €10K/ha, rising to around €145K/ha for a Pouilly-Fumé vineyard, and €140K/ha in Sancerre.

Finally, in the Rhone, prices are again very diverse. At the top end prices rose considerably for the vineyards of Hermitage and Côte-Rotie (€1mK/ha), to Châteauneuf-du-Pape (€350K/ha) where prices lifted slightly, down to the stagnating Côtes du Rhône, starting at around €12K/ha, but with IOP vineyards lower. Much of the region a relatively closed market, with most purchases to local buyers.

Prices for individual vineyards may well fall out of these ranges, which are merely zonal averages. In addition, in some areas the market is small, which will inevitably distort averages for these areas.

Next Article: Notaires Must Provide Interpreting Support

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.