French Income Tax Return 2020 - Foreign Pension Income

Thursday 14 May 2020

How to declare your pension income on your French income tax return for 2020.

The taxation of foreign pension income in France depends on the terms of the relevant tax treaty between France and the country of origin.

As a general rule, such income is taxable in France. Pension income also includes early retirement pensions.

The main exception to this general rule are UK government service pensions, which are not taxable in France. Nevertheless, they still need to be declared on your French tax declaration, as it will be used to determine the rate that applies on your French taxable income.

Government service pensions are paid to former members of HM Forces (including widows), ex Civil Service and Foreign and Commonwealth Office employees, as well as ex local authority, police, teachers, fire service and Forestry Commission employees. National Health service pensions are not considered to be a government service pension except where they are paid by a local authority. Neither are university pensions, except those from Oxford University.

On-Line Account

The form to declare your income is the main return, F2042.

To declare on-line you will need to connect to Impots.gouv.fr and click on 'Votre Espace Particulier' and create an account with 'Création de mon espace particuliere.'

You will need to obtain from your first tax notice (avis d'imposition) your:

- Numéro fiscal;

- Numéro d'accès en ligne;

- Revenu fiscal de référence.

If you have not previously made a declaration you will need to submit a paper declaration.

Form 2042

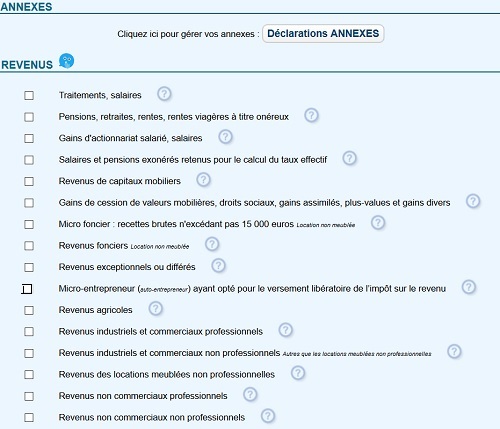

To declare your pension income on-line, on the F2042, in the 'Étape 3' page titled 'Revenus et Charges' you need to tick the box 'Pensions, retraites, rentes............'. You will also need to tick other boxes for other income, although some may already be ticked by the tax authority if you have previously made a tax declaration in France.

The graphic below shows the page and the relevant box. If you are making a paper declaration it does not apply.

To complete your tax return, you need to go the main Form 2042, section 1, under the heading ''Traitment, Salaries, Pensions et Rentes'. The term 'rentes' does not refer to rental income, but annuity income.

Government service pensions from the UK should be declared in Boxes 1AL and 1BL, as appropriate, 'Pensions de source étrangère avec crédit d’impôt égal à l’impôt français'.

Those in receipt of a UK government service pension also need to enter the same amount in Section 8, 'Divers', Box 8TK, 'Revenus de source étrangère ouvrant droit à un crédit d’impôt égal à l’impôt français'.

Such income is automatically excluded from the calculation of social charges that may apply on other income.

Other pensions, such as the State retirement pension and private pensions taxable in France should be declared in Boxes 1AM and 1BM, as appropriate, 'Autres pensions imposables de source étrangère'.

You may also pay social charges in such income, which you can read about in our article Pensions and Social Charges 2019.

Form 2047

If the pension was paid into an account into the UK or other country, then you also need to complete Form 2047, 'Déclaration des revenus encaissés à l'étranger'.

Strictly speaking, any income originating from outside of France, even if paid into a French bank account, should be entered on the form, but it is not a rule that is not generally enforced by local tax offices, provided the income is given on the tax return.

- If the pension is taxable in France it should be entered in Section 1/11, giving the country where it was paid in, whether public or private and the amount in euros.

- If the pension is not taxable in France, then those in receipt of a UK pension should enter it in Section 6 'Revenus de source étrangère ouvrant droit à un crédit d’impôt égal à l’impôt français'.

Although you will need to convert the foreign income into euros, there is no need to establish the rate that applied at the time each payment was made into your account. It is enough to use the average of the rate that applied on 1st Jan 2019 and 31st Dec 2019. Tax offices find that a perfectly acceptable approach. Working out whether you have converted the income at the correct rate is probably the least of their pre-occupations with your return.

Lump-Sum Pension Payments

If you have received a lump-sum foreign pension then it is taxed on a different basis, and you complete your tax return in a slightly different manner. We have provided some general guidance on the taxation of such pensions at Taxation of Lump-Sum Pensions in France.

The information given here can only be of a general nature. If you are unsure do take professional advice.

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.