Sterling/Euro Currency Review September 2014

Tuesday 07 October 2014

Sterling rallied to just short of a six-year high against the euro last month, says Ben Scott.

September saw GBP/EUR trading in an extremely impulsive manner as voting on the referendum regarding Scottish independence caused huge market volatility in the first half of the month.

Concerns that the Scottish independence vote was becoming too close to call climaxed with one poll suggesting there had been a huge swing in support of the ‘Yes’ vote putting this camp at close to a 54% lead against 46% for ‘No’.

David Owen of Jefferies suggested that a ‘Yes’ vote would be Sterling negative and would influence monetary policy stating, “We can expect the market to quickly price out a rate rise for a long time to come”. This caused significant Sterling weakness with some analysts forecasting a drop in the pound’s value of up to 10% if Scotland successfully voted for independence.

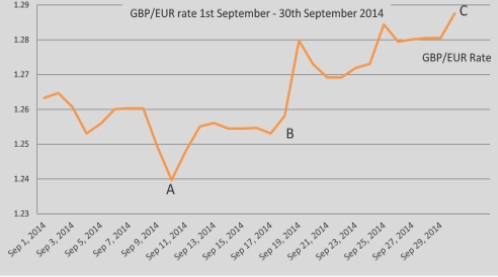

These concerns resulted in a low of 1.2397 (Interbank throughout), as Sterling slid to three-month lows against the euro as illustrated by point A on the graph.

However, after Scotland rejected independence Sterling gains resumed on the back of improved UK fundamentals.

Continued efforts by the European Central Bank (ECB) to talk down the value of the euro, resulted in GBP/EUR hitting a high of 1.2876 on September 30th - the highest level for 26 months and just short of six-year highs. GBP/EUR traded at an average rate of 1.2637 throughout September.

Broadly speaking, UK economic data remained relatively positive in early September with industrial and manufacturing production providing positive results. Whilst the announcement from the Office for National Statistics that UK unemployment fell in the three months (to the end of July), to its lowest level since 2008, would normally have boosted Sterling, especially with Europe remaining lethargic in tackling its economic woes, early September proved extremely unstable and unpredictable for the pound.

Europe reported disappointing economic results including manufacturing data for Germany and for Europe as a whole, and extremely poor European retail sales figures, which added to fears of disinflation. These disappointing figures contributed to the ECB’s surprise decision to cut interest rates to fresh record lows of 0.05% from 0.15%.

It was the announcement from ECB President Mario Draghi, however, that the ECB planned to introduce asset-backed securities (ABS), a form of quantitative easing (QE), with details set to be released at the start of October, which prevented any further euro gains during this period for the pound.

Sterling gains immediately after point B came as a result of Scotland emphatically rejecting the chance of independence in preference of remaining part of the United Kingdom.

However, with this result largely expected in the week leading up to the referendum, and on the backdrop of falling UK inflation, which further reduced the prospect of the Bank of England (BOE) hiking interest rates this year (forecasts now predicting Spring 2015), Sterling gains were relatively small and extremely short-lived.

After a period of consolidation Sterling did manage to push to fresh two-year highs against the euro (point C), a high just 3 pips short of the highest level for six years.

Sterling’s gains during this period can largely be attributed to BOE Governor Mark Carney who provided a boost to Sterling by suggesting an interest rate hike was edging ever closer, stating, “with many of the conditions for the economy to normalise now met, the point at which interest rates also begin to normalise is getting closer”.

This was supported on 30 September by a slightly higher than expected gross domestic production (GDP) figure, which indicates the UK economy continues to grow at an extremely positive rate, adding further support to the pound.

Outlook

Renewed positivity surrounds Sterling after avoiding a potential catastrophe with the Scottish referendum and improving economic data from the UK, which lead to bullish comments from BOE Governor, Mark Carney, that “rate rise by spring 2015 is consistent with goal”.

However, there remains a cautious view going forward with UK net borrowing rising significantly, suggesting the UK continues to struggle to deal with its significant debt obligations. Concerns increased by UK Chancellor, George Osborne, who recently warned that “the risk to the UK economy is not over”.

Elsewhere, a warning from the British Chamber of Commerce that they expect “weaker exports to affect long-term growth prospects”, points to a slowing of the UK economy going forward, which would have a negative impact on Sterling.

Given the consistently disappointing economic data from the eurozone and the ongoing policy of France to push for further euro weakness as a means of improving exports, it is surprising just how resilient the euro remains.

September saw ECB President Mario Draghi again repeating the ECB’s commitment to “using all instruments at their disposal” in an apparent effort to devalue the euro further. With new measures of QE imminently being introduced, further euro weakness in the short-term remains a very real possibility.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: Local Rates Rebates 2014

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.