Sterling/Euro Currency Review Sept 2015

Friday 02 October 2015

September proved to be another disappointing month for euro buyers as sterling failed to recover any losses experienced during August before steadily declining in the second half of the month, says Ben Scott.

With growth prospects remaining challenging, sterling experienced a reality check after an extremely positive year so far, when a survey from the CBI (Confederation of British Industry) and the accountancy firm PWC (Price Waterhouse Coopers) was released. The survey claimed business volumes across financial services companies rose at the slowest pace for two years, following a two year period of robust expansion.

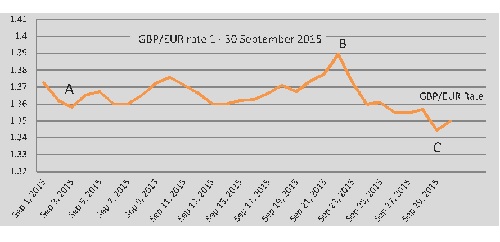

After a period of relative stability throughout early September a GBP/EUR high of 1.3894 (Interbank throughout) as illustrated by point B on the graph, was followed by a period of sterling declines resulting in a low of 1.3445 (point C). The GBP/EUR pair traded at an average rate of 1.3652 throughout September.

Sterling started the month on the back foot with a plethora of economic data coming in below expectation. Industrial production, manufacturing, construction and service sector PMI (purchasing managers’ indices) all disappointed to the downside in the first week of September.

When combined with the pressure caused by the Chinese economic slowdown and uncertainty it created in the global stock markets, concerns surrounding sterling’s ability to remain at current elevated levels became accentuated.

Short term gains for sterling from point A came as a result of comments from the ECB (European Central Bank), which indicated that their current quantitative easing programme could run beyond September 2016 as currently expected.

Additionally, the euro was also damaged by revised European Central Bank GDP (Gross Domestic Production) forecasts, which showed economic growth in 2015-2017 is unlikely to be as high as previously expected, making the euro a far less attractive investment and allowing Sterling to recover some losses.

Sterling was supported throughout the middle of the month by comments from Bank of England member Kristin Forbes who stated, “UK interest rates are likely to rise sooner rather than later”. Having said this, later contradictive comments from the Bank of England’s Chief Economist, Andy Haldane: “The Bank of England may have to cut rates to combat low inflation rather than raise them as their next move”, before going on to say that the case for raising interest rates were, “a long way from being made”. This showed the lack of unity and uncertainty within the Monetary Policy Committee and lead to significant sterling weakness, adding to concerns going forward.

With the announcement that the NIESR (National Institute of Economic and Social Research) had reduced prior UK growth estimates from +0.7 to +0.5%, along with inflation falling back to 0.0% and showing no signs of pushing back towards the 2% target in the short-term, sterling found itself under significant pressure leading towards the end of the month.

A rate cut, whilst unlikely, is becoming more of a viable option to stimulate growth and inflation. UK interest rates have now been on hold at record lows (0.5%) for more than six years and whilst a rate cut remains unlikely, further talk of rate cuts would lead to further sterling weakness.

GBP/EUR flirted with its lowest level in eight months (point C) as the euro was boosted by bullish comments from ECB President, Mario Draghi, who, whilst refusing to rule out the prospect of an extension to the ECB quantitative easing programme, went on to present an extremely positive economic outlook for the Eurozone.

Elsewhere, Greece took another step towards political stability with the re-election of the Syriza Party lead by previous Prime Minister, Alexis Tsiparas. The Syriza party’s success fell only just short of an overall majority, but boosted the euro as political uncertainty is removed for the time being.

Although there was some concern that Prime Minister Tsiparas could derail the most recent Greek bailout if he were to renege on previously agreed austerity measures, these concerns had little impact on the single currency.

Outlook

Whilst a run of weak economic data from the UK has significantly reduced the prospect of an interest rate increase from the Bank of England this year, a continued decline in the rate of unemployment in September, 5.5% against a forecast level of 5.6% meant unemployment has now dropped 2% since the middle on 2013 amid an increase in both business and consumer confidence.

Economic data from the Eurozone continues to disappoint with important consumer confidence, Eurozone investor confidence and German ZEW all showing significant declines as concerns surrounding the economic instability in China lead to further uncertainty throughout the Eurozone.

Of more concern was the announcement that Ireland’s manufacturing growth hit an 18-month low in September. With growth beating forecasts in Greece in recent months there must be concerns that Ireland, which has been following the terms of their financial bailout, will start considering if sticking to the terms of their bailout is beneficial.

Elsewhere, with one in six German employees being employed by the motor industry, there are growing concerns that as the recent Volkswagen scandal grows, the German and the wider European economy could find itself in significant trouble with an anticipated fall in exports.

Speculation is that the scandal is likely to negatively impact both exports and lead to higher unemployment, which will prove extremely detrimental for the euro. Volkswagen will hope that the resignation of Chairman Martin Winterkorn, who is to be replaced by former Porsche CEO, Matthias Muller, will boost confidence, but short-term euro weakness seems possible.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: Social Charges Refund

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.