Sterling/Euro Currency Review November 2014

Thursday 04 December 2014

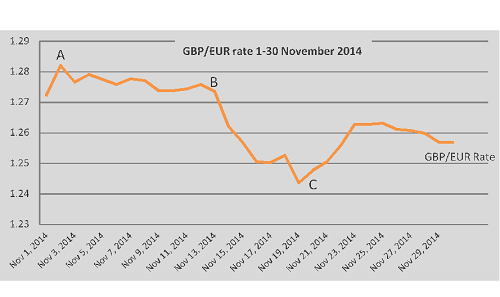

After a period of relative stability, and close to six-year highs against the euro in the first half of the month, poor economic data and increased inflationary pressures later forced Sterling lower, says Ben Scott.

Sterling losses during this period came in spite of the ongoing reluctance of the European Central Bank (ECB) to introduce a full programme of quantitative easing (QE), something seen by many as the only remaining option to kick-start economic growth in the eurozone.

Despite the announcement that the eurozone had marginally avoided slipping back into recession, euro buyers will remain concerned by the inability of Sterling to push higher in the face of the ongoing economic difficulties gripping the eurozone.

An initial GBP/EUR high of 1.2820 (Interbank throughout) as illustrated by point A, was followed by a period of uncertainty, including a low of 1.2436 (19 November 2014), trading at an average rate of 1. 2657 throughout November.

Economic data from the eurozone continues to disappoint, with particular concern created by the announcement that Portugal was struggling to continue economic reform since exiting its aid programme. A joint statement from the ECB and EU noted, “Portugal has lost momentum on structural reforms since exiting aid programme”. This added to on-going concerns surrounding Greece’s ability to develop and maintain economic stability when financial support from the EU ends 1 January 2015.

Comments from ECB President, Mario Draghi, stating that the ECB policymakers were, “unanimous, in their readiness to take more action on monetary easing to maintain price stability and curb a slowdown in economic growth if necessary” again highlighted the very real prospect of a full scale QE programme which would almost certainly devalue the euro.

Sterling continued to be troubled by disappointing economic data, including a decrease in construction figures and the lowest service sector figures for seventeen months, a main component to UK gross domestic production data. This once again raised concerns of the UK’s economic recovery slowing down which caused further losses for Sterling against the euro.

Sterling weakness from point B came despite a further fall in UK unemployment, which dropped by 115,000 between July and September.

However, an extremely negative inflation report from the Bank of England (BOE) provided the catalyst for Sterling weakness.

Governor Mark Carney announced, “Inflation is likely to fall below 1% over the next six months”, which is well below the BOE inflation target of 2%, dampening expectations of an interest rate increase in the UK, which would ultimately have encouraged investors and increased the value of the pound. HSBC now forecast a first interest rate hike from the BOE in Q1 2016 from a previous forecast of Q1 2015.

BOE Governor Carney highlighted concerns gripping the eurozone stating that the “spectre of stagnation (is) haunting Europe”, whilst a report from the OECD (Organisation for Economic Co-operation and Development) pointed to further weakness in the eurozone - most notably Germany and Italy.

Nevertheless, the euro was able to add to gains against Sterling on the announcement that the eurozone and Germany was able to dodge a technical recession, with data indicating a combined economic growth of 0.1% for the Q3 2014. Whilst this by no means signals the end of the eurozone’s economic troubles, it does mean that growth remains positive, which should reassure investors providing underlying support for the euro. Euro gains were further supported by a far better than expected sentiment survey which surprisingly displays a growing optimism for the eurozone economy going forward.

Despite comments from UK Prime Minister David Cameron that “Global economy warning lights are flashing”, and that a “dangerous backdrop of instability threatened Britain’s recovery”, Sterling was able to recover some losses from point C as a result of the announcement that eurozone economic growth hit a 16-month low. This led to analysts to warning that the ECB is under pressure to take more action, with further stimulus likely to prove detrimental to the euro.

Outlook

Concerns grow that the UK economic recovery remains unbalanced. The announcement by the Office for National Statistics (ONS) of a significant improvement in retail sales figures, which grew to 4.6% on the year in October from 2.8%, appear very encouraging.

However, with wage growth subdued, it again raises the concern that purchases on credit remain disconcertingly high, adding further to the uneven and unaffordable recovery.

A speech from Prime Minister David Cameron indicating that emerging markets, the driving force of growth during the early stages of the UK economic recovery, are now slowing down raises concerns for the sustainability of the UK’s ongoing recovery.

Whilst the European Commission has cut eurozone growth forecasts for 2015 from 1.7% to 1.1%, indicating a slow and arduous recovery, similar concerns exist in the UK with forecasts for economic growth in 2015 being revised lower by several sources. The announcement that UK mortgage lending in October was at the lowest level since January 2014, suggests the new mortgage rules are having a negative impact on lending, which could prove damaging to the UK housing market - a key contributor to economic improvements in the UK.

The eurozone remains on the brink of a third recession as a result of high unemployment, falling economic growth and the ongoing threat of deflation. Concerns which look set to continue in the medium-term, as illustrated by comments from the OECD (Organisation for Economic Co-Operation and Development) which forecasts a “large downside risk to EU forecasts”.

Further comments from the OECD that the “ECB should add stimulus to counter to deflation" seems to support forecasts from Goldman Sachs, which expects the ECB to conduct sovereign QE in the first half of 2015, which is likely to make the euro a far less attractive investment going forward.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: Building Land Prices 2013

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.