Sterling Euro Review May 2017

Tuesday 13 June 2017

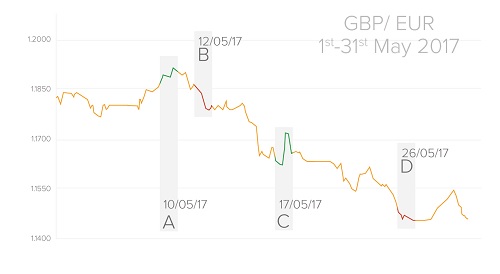

The sterling to euro exchange rate fluctuated in May between €1.1432 and €1.1919, with the pound’s major weakness the political instability that continues to impact the UK, writes Ben Scott.

UK General Election

Since Theresa May has been Prime Minister there have been several positive shifts in the pound, but unfortunately for investors in sterling it has recently started to lose ground.

In January, a speech regarding her strategy for Brexit caused a massive GBP/USD rally, when it climbed over 3% in one day. Similarly, an announcement in April stating a snap election would take place allowed sterling to rally another 2%.

But the formerly concrete view that the election would be an easy win for the Conservatives disintegrated fast in the month as May’s standing in the polls continued to slide.

Industry expert Chris Turner commented: ‘Investors had assumed the election was a done deal and was going to deliver this stunning majority. But the polls have pulled the carpet from under their preconceived notions.’

The polls made for The Times by YouGov suggested the Conservatives could lose the majority by 16 seats, meaning a hung parliament would be necessary, a development extremely damaging for the pound.

Turner continued: ‘Compared to where we were a few weeks ago, when we were looking at a majority of 100 to 150, if the Tories end up with an increase only in the tens, that will be a big disappointment for the market.’

Theresa May also hindered sterling strength when she released her manifesto and quickly made a U-turn on one of her prominent social care policies after her party revolted against it. This quick retreat doesn’t bode well for the upcoming Brexit negotiations, as concerns heighten that the UK could end up with a bad deal if the nation shows weak leadership.

French Election Victory Dies Down

The French election result had seen the euro gain strength against other majors, but the victory soon muted and the pound was able to regain some ground.

Although Emmanuel Macron had a strong win in the election, there was speculation that his new party En Marche! was likely to be tested in the upcoming parliamentary elections.

Economic Data to Impact the Pound in May

The pound wasn’t offered any support when UK gross domestic product (GDP) data showed the economy only expanded by 0.2% in the first quarter of 2017 – the lowest figure of the Group of Seven (G7). The US didn’t perform much better, registering a figure of 0.3%, but Canada steamed ahead with growth in the region of 0.9%.

However, on a more positive note, the British Retail Consortium’s (BRC’s) retail sales number showed some improvement. The key indicator noted that after a dismal few months UK consumers were spending once again, brushing off Brexit related slowdown fears. Sales increased by 5.6% year-on-year in April; retail sales are watched by many as it makes up a chunk of the UK’s consumer spending within the economy.

Paired with the shine from the French election dissipating, the GBP/EUR exchange rate was able to register gains (point A).

Super Thursday Shatters Pounds Strength

However, the gains were short-lived (point B) as the GBP/EUR rate shed losses on Bank of England (BoE) developments.

On 'Super Thursday', the bank’s Monetary Policy Committee (MPC) decided to once again keep rates on hold (in a 7-1 vote) and made comments regarding wages and inflation. Slow wage growth has plagued the UK economy for some time, but BoE Governor Mark Carney expects pay to improve in the future.

Carney said: ‘Our central expectation is that we do expect wages to pick up and real income growth to turn positive over the course of the next few years and that is during the period of leaving the EU.’

However, Carney stated that British citizens will be facing a tough year as inflation continues to squeeze households. He said that wage growth would turn negative in real terms, unable to keep up with inflation.

Carney commented: ‘This is going to be a more challenging time for households. Wages won’t keep up with prices for goods and services they consume.’

Following this, the UK’s consumer price index (CPI) showed inflation had jumped to 2.7% year-on-year in April, from 2.3% the month before. Economists had expected a much smaller adjustment to 2.4%. Eurozone inflation also registered an increase from 1.5% to 1.9% in April on the year.

Prime Minister May also revealed the UK’s unemployment level had fallen from 4.7% to 4.6%, despite economists predicting it would hold steady. The figure reached a 42-year low and afforded the pound some strength against the single currency (point C). Eurozone unemployment also enjoyed a tumble, falling to the lowest level since 2009, around the time of the Global Financial Crisis, at 9.3%.

The GBP/EUR rate slipped again towards the end of May (point D) as polls suggested the Conservative lead had narrowed once again.

Italian Election Prospects Could be Concerning for the Euro

The likelihood of further political instability is a factor that could weigh on the euro this year.

As lawmakers approach an agreement with regards to the electoral processes in place, some are suggesting a snap election in Italy could be held as soon as September. Lawmakers are discussing a proportional voting system, taking inspiration from the model used in Germany. Former Prime Minister Matteo Renzi has suggested that Italians should head to the polls in September, in order to align their voting schedule with the Germans.

Renzi stated: ‘Voting with Berlin would make sense for many reasons on a European level, and would allow the new parliament to set five years of economic policy without losing a day.’

The German elections are likely to cause some instability and the added prospect of Italy going to the polls alongside Germany could cause further euro movement. The last Italian election caused significant EUR movement as voters decided on whether to elect a pro or anti-EU party. It is possible that feelings have changed since the end of last year and an upcoming snap election could be a most interesting event to watch.

Another factor that may impact the euro exchange rate will be the European Central Bank’s (ECB’s) language with regards to monetary policy. Euro bulls are hoping the central bank will make adjustments to its policy in the near future – something the ECB has said will only happen gradually.

Moreover, Greece has made its way back into the spotlight again and concerns there could cause EUR depreciation.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.