Sterling/Euro Currency Review March 2014

Tuesday 08 April 2014

March saw Sterling continue to trade in a relatively tight range despite experiencing downward pressure for much of the month, says Ben Scott.

Economic data from the UK continued to reflect economic improvements. However, with analysts suggesting much of the good news being released from the UK is now factored into the market, an upturn in economic data from the eurozone and positive euro rhetoric from European Central Bank (ECB) President Mario Draghi (particularly in the early weeks of March), was a key contribution to Sterling weakness.

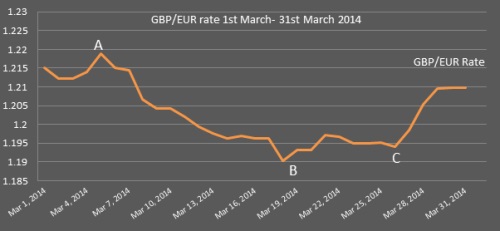

GBP/EUR reached a month high of €1.2189 (Interbank throughout), but was followed by a period of gradual decline resulting in a low of €1.1903 on 18 March 2014, trading at an average of €1.2027 throughout the month.

Coming into March, manufacturing, industrial production and service sector figures all provided evidence of an improving, yet decelerated economic recovery in the UK, resulting in the month’s high 5 March 2014 (point A on the graph).

Improving economic data from the eurozone, however, showing better than expected German and eurozone economic growth, combined with data revealing eurozone companies experienced their fastest growth rate in two-and-a-half years proved the catalyst for the European Central Bank to raise growth forecasts, adding significant strength to the euro.

Whilst positive comments from ECB President, Mario Draghi, added to the growing bullish sentiment for the euro, conservative comments from Bank of England Governor Mark Carney undoubtedly contributed to Sterling’s decline during the first half of March.

Governor Carney again downplayed the potential of a rate hike when the UK’s unemployment rate reaches 7%, emphasising the need to re-assess and not immediately act on monetary policy once unemployment reaches 7%. He further added to concerns with talk of an easing-off in the rate of economic recovery by claiming, “...data suggests [a] slowdown in [the] unemployment drop” leading to a considerable weakening of Sterling.

Analysts now forecast a diminishing potential on a rate hike for the first half of 2015, making Sterling a far less attractive investment.

After the euro strengthened nearly 2.5% in just over a week against the pound, point B on the graph represents the month’s low for GBP/EUR as concerns surrounding the Russian/Ukraine conflict reached a heightened level of concern.

Comments from George Osborne, the Chancellor of the Exchequer, during the 2014 Budget, escalating UK’s economic growth forecasts from 2.4% to 2.7% saw Sterling rally. However, any further recovery was prevented by concerns of falling inflation in the UK. Inflation below the 2% Bank of England target reduces the potential of any interest rate increase, again diminishing the appeal of the Pound.

Positive Sterling gains from point C, resulting in a sustained break above €1.20, can partly be attributed to positive comments from Bank of England member, Martin Weale, expressing optimism over the resurgent UK economy. A sentiment supported by far better than expected retail sales data.

However, Sterling’s rally can more significantly be credited to a clear change in sentiment from both ECB members, and slightly more surprisingly, from Bunderbank President, Jens Weidmann, who demonstrated a willingness to consider additional monetary policy despite previously opposing such a measure as a means of countering low inflation.

Further monetary stimulus, particularly the rumoured introduction of Quantitative Easing, by the ECB would undoubtedly see a sustained period of euro weakness, as seen in previous years in both the UK and US.

Outlook

Whilst the UK’s economic outlook continues to improve, there are a growing number of indicators suggesting the UK’s recovery is as a negative result of consumer borrowing and a new housing bubble rather than an increase in demand, investment or purchasing power. All of which points to an uncertain economic recovery going forward.

Whilst the euro continues to demonstrate a remarkable resilience, the growing speculation that the ECB is set to implement its own form of Quantitative Easing would undoubtedly prove detrimental to the euro.

Meanwhile Germany looks set to be the biggest economic loser as a result of the Russian/Ukraine conflict and consequential sanctions, due to their significant economic ties with Russia, meaning further weakness in German economic data looks likely, to the detriment of the euro.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: How Much do French Politicians Earn?

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.