Sterling/Euro Currency Review June 2015

Thursday 02 July 2015

A disappointing end to May continued into June for sterling with economic data from the UK remaining rather mixed, says Ben Scott.

Important service sector and manufacturing data for May disappointed, whilst construction data for the same period proved positive.

A lack of significant progress regarding Greek debt negotiations were again strikingly obvious when Greece failed to reach a deal within a self-imposed period at the start of June.

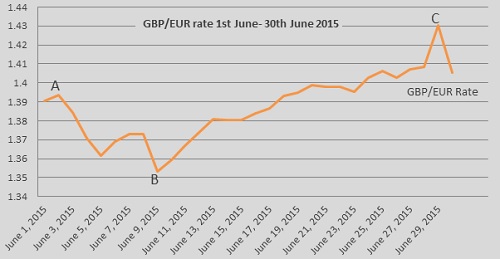

Having said this, positive sentiment, including comments from Greek Prime Minister Alexis Tsipras, early in June were seen as a positive with an agreement appearing imminent contributing to a GBP/EUR month-low of 1.3532 (9 June 2015). Tsipras was referring to the emergence of a “realistic proposal” with the International Monetary Fund (IMF) and Greece’s creditors, which included difficult concessions to be made by Greece’s.

However, due to the lack of an agreement being forthcoming the GBP/EUR pair reached a fresh seven-year high of 1.4305 (Interbank throughout) as illustrated by point C on the graph, as Greece teetered on the brink of default and therefore leaving the European Union (EU) with GBP/EUR trading at an average rate of 1.3878 throughout June.

Sterling gains from point B came after Greece missed a repayment of €300million to the IMF, claiming they were simply delaying the payment until June 30th when a full payment of €1.5 billion was due.

Nevertheless, the lack of clarity and uncertainty amongst European leaders surrounding the Greek debt crisis was again the key factor for euro weakness leading to point C on the graph.

Whilst Greece continued to drive headlines, countless negotiations between the indebted nation and its creditors ended without a resolution, raising both the risk of Greek insolvency and the anger, frustration and distrust between the various parties - much to the detriment of the euro.

The Greek debt situation finally appeared to reached its conclusion on Friday 26th June when Greek Prime Minister, Alexis Tsipras, shocked the IMF, EU (European Union) and other creditors of Greece by breaking off unilateral negotiations and pledging a surprise referendum to the Greek people on the terms of the deal offered by the creditors, (with the government firmly backing a ‘No’ vote).

Following these developments, Saturday 27th saw the creditors of Greece sensationally deny a request from Greece for an extension to its debt obligations, plunging the nation into crisis.

With banks set to remain closed until at least 5 July (referendum date), Greece is undoubtedly in turmoil with a Grexit looming larger every day, particularly after becoming the first developed country to ever miss a payment to the IMF.

Outlook

Sterling was boosted at the end of June by the release of stronger than expected gross domestic production (GDP) data from the Office of National Statistics, which showed UK economic growth between January and March rose 0.4% against a previous forecast of 0.3%.

Sterling gains towards the end of June, however, were limited by words of caution from Chancellor George Osborne, who told the House of Commons that a Greek exit from the eurozone would “have a big impact on the stability of the financial system and represented one of the biggest external risks” to our economy. These comments came after information emerged revealing that a Greek exit from the eurozone could land British tax payers with a bill totalling hundreds of millions of pounds.

Elsewhere, Bank of England (BOE) Chief Economist, Andrew Haldane, highlighted the risk of increasing interest rates in the UK, cautioning “hiking rates too early will increase the chance of a recession”.

Although Andrew Haldane does seem to be the lone member of the Monetary Policy Committee (MPC) leaning towards cutting interest rates as oppose to increasing them, these comments do highlight the risks and could see any interest rate hike delayed even further making sterling a far less attractive investment.

Eurozone economic data has largely taken a back seat in recent months given the ongoing Greek crisis and that looks set to remain the case despite recent improvements in some sectors of the EU’s economy. A point highlighted by European Central Bank President, Mario Draghi, who announced the eurozone’s recovery is “set to broaden” before raising inflation forecast for 2015.

In normal economic circumstances this would have almost certainly have resulted in euro strength, meaning if a resolution is eventually found, despite Greece defaulting on its debt obligations, the euro could be in the position to make significant gains. Anyone looking to send money over to France in the medium term, should certainly keep this in mind and possibly consider a Forward Contract as any movements could heavily impact the cost of any overseas transfers.

Meanwhile, the Greek referendum on 5 July, seems too close to call. A ‘No’ vote will almost certainly result in Greece leaving the European Union. While a ‘Yes’ vote is likely to see the collapse of the Greek Government, and although this will create even more short-term uncertainty, a New Greek government will likely to be more receptive to the IMF, EU and its creditors’ demands, therefore increasing the likelihood of Greece’s continued membership of the European Union.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: Vineyard Prices 2014

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.