Sterling in Free Fall over Brexit

Thursday 03 March 2016

February proved to be an extremely disappointing month for euro buyers as concerns grew about UK political stability, writes Ben Scott.

Sterling weakness intensified after the apparent failure of UK Prime Minister, David Cameron, to achieve significant concessions from the European Union regarding the UK’s continued membership.

Sterling losses against the euro have touched 7% this year already as uncertainty grips the market ahead of the UK referendum.

The disappointing outcome of drawn-out discussions led several heavy weights of the Tory Party to defy the party leader, David Cameron, and quickly throw their support behind the push for a vote to leave the European Union.

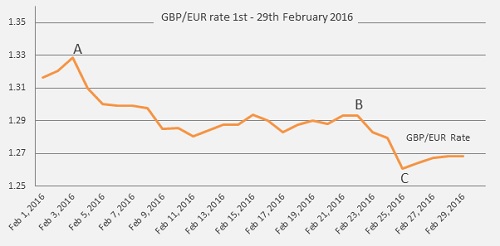

This led GBP/EUR to the lowest level for 14 months, hitting a low of 1.2609 (interbank throughout), illustrated by point C on the graph, as Bank of England Governor, Mark Carney, suggested a ‘Brexit’ would “leave the UK dependent on the kindness of strangers”.

Despite ongoing anxieties surrounding the UK economy, similar concerns remain in the eurozone, meaning sterling losses were prevented from being significantly worse.

Nevertheless sterling losses were still significant, with GBP/EUR trading at an average rate of just 1.2909 throughout February.

The euro started February on the back foot allowing a GBP/EUR high of 1.3286 on 3rd February, as illustrated by point A, after the European Central Bank’s (ECB) President Mario Drahi admitted the “credibility” of the European Central Bank was at risk if it fails to boost inflation back towards the target level of 2%.

This was taken as an indication that the ECB could well escalate the level of quantitative easing currently injected into the economy as a means of boosting both inflation and economic growth, which would have the effect of devaluing the euro.

Sterling weakness during February was accentuated, firstly by comments from BoE member, Kristen Forbes, who stated, “The outlook for UK inflation does not warrant an interest rate rise any time soon”.

A downgrade in the BoE growth forecasts for 2016, down from a previous forecast of 2.5% to 2.2% also weighed on the pound.

Whilst economic data from both the UK and eurozone has had some impact, economic concerns took a back seat with uncertainty surrounding the UK’s continued membership weighing heavily on the pound throughout the month before the sharp decline from point B.

Point B represents the point where Prime Minister David Cameron confirmed that terms had been agreed and that he would be proceeding with a UK referendum on Britain’s continued membership of the European Union. He further made it clear he would back remaining part of the EU on the back of the concessions agreed.

However, sterling declines between points B and C were partly as a result of the support added by key politician Boris Johnson to the ‘Out’ campaign, with Johnson being one of many politicians backing the UK to leave the European Union.

Sterling losses during this period also came about as significant scaremongering from pro-European supporters who raised concerns of how the UK would function out of the EU, and, as is always the case, the market responded negatively to uncertainty.

Uncertainty which was not helped by claims from banking giants UBS and HSBC who both claimed that in the case of a UK exit sterling could push towards parity. Deutsche Bank described the prospect of a Brexit as a “Journey down the rabbit hole for the UK economy”.

Outlook

GBP/EUR movements over the next four months will largely be dictated by ongoing speculation over the prospect of whether the UK remain a member of the European Union, with forecasts now suggesting the potential of leaving is now around 40% - according to UBS. This is much higher than anticipated and likely to lead to further sterling weakness if supports grow further.

It is worth noting that after Governor Mark Carney stated that the BoE “were fully prepared to act if the UK economy got any worse” and that “cutting interest rates could be a tool within their arsenal”. Investors now attach a greater possibility of an interest rate cut in the UK over the coming months than a possibility of an interest rate hike given global economic uncertainty, speculation which could result in further sterling losses.

As previously mentioned in these reports, there are ongoing concerns as to whether the Bank of England does more harm than good to the stability of sterling with regards to their policy of ‘forward guidance’.

This was a concern supported by comments from Dominic Rossi, Global Chief Investment Officer of Equities at Fidelity, who suggested the Bank (BoE) had been poor at understanding why inflation was so low, whilst also critcising the Bank of England governor for being “too aggressive” when predicting interest rates may rise early in 2015.

If the Bank of England persists with its muddled policy of ‘Forward Guidance’ while world markets remain in a state of turmoil, then high levels of volatility look set to remain. A concern further supported by the fact that on the 23rd of February the day that Governor Mark Carney, when speaking to the Treasury Select Committee, gave his clearest indication to date that the Monetary Policy Committee may vote for an interest rate cut in coming months. Deputy Governor, Nemat Shafik, stated that she believes that the “next interest rate move will be up”.

Whilst the euro has been the benefactor of uncertainty in the UK in recent months, euro prospects, whilst still hindered by poor economic performance, seems to rest largely on which path the European Central Bank takes on quantitative easing.

Elsewhere Greece’s stock markets plunged during February over concerns that the bailout review had hit a snag. With Greece never far away from the headlines the euro could be under pressure if there is any further speculation of a debt default by Greece.

A Place in the Sun Live, French Village, Manchester

We shall be present in the French Village at A Place in the Sun Live international property exhibition at Manchester next week, when we shall be making a presentation on the outlook for sterling and we shall be available for individual consultations.

You can also contact Ben Scott at FC Exchange on the link below.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: Managing an Inherited Property in France

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.