Sterling/Euro Currency Review August 2015

Wednesday 02 September 2015

August proved to be an extremely disappointing month for euro buyers as the single currency once more demonstrated its remarkable resilience, says Ben Scott.

With the Greek debt crisis having largely dictated GBP/EUR movement in recent months, taking a back seat after the agreement of the most recent Greek bailout, economic data dictated movements on the currency pair.

Sterling suffered as expectations of an interest rate in the UK were pushed further into the future, with some economists now predicting that the Bank of England (OE) may refrain from hiking interest rates until 2017. Bank of England Deputy Governor, Ben Broadbent, demonstrated this by claiming, “There is currently no urgency to hike interest rates”, disappointing some investors who had pencilled in a rate hike as early as November 2015.

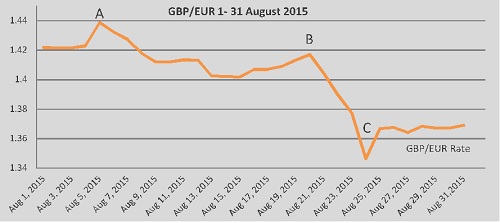

A GBP/EUR high of 1.4386 (Interbank throughout) as illustrated by point A on the graph, was followed by a period of almost continuous decline for sterling after failing to break through recent multi-year highs, cumulating in a 10-week low of 1.3462 (point C), with GBP/EUR trading at an average rate of 1.4042 throughout August.

Despite disappointing economic data from both the UK and the eurozone, Sterling had started the month positively and gains leading to point A on the graph came as a result of a growing belief, leading up to so called “Super Thursday” (Thursday 6th August), that up to three members of the Bank of England Monetary Policy Committee (MPC) could have voted for an interest rate hike in August.

Historically, interest rate decisions and how the vote was split is published two weeks apart. However, August represented the first example of both the result and vote being published at the same time. Enthusiasm for Sterling quickly diminished though as it was announced that only Ian McCafferty had voted for a hike, ultimately removing any lingering hope of an interest rate hike this year.

The euro was boosted by positive German Institute of Economic Research business climate data, which showed manufacturers, builders, wholesalers and retailers were far more optimistic about business conditions than originally anticipated, giving a further boost to growth expectations in the eurozone.

The euro was also boosted leading up to point B on the graph by the completion of the €86 billion Greek bailout which allowed Greece to make a significant payment to the ECB (European Central Bank).

Meanwhile Sterling weakness in the middle of August was accentuated by disappointing employment data from the UK indicating the number of people in work fell by 63,000.

Extremely disappointing retail sales for July of just +0.1% against an expected reading of +0.4% contributed to Sterling loses leading to point C on the graph.

However it was the fallout of Chinese stocks and the realisation that the second largest economy in the world was experiencing a significant slowdown which allowed the euro to experience positive gains as flows left the US and flooded into the euro.

It became clear that combined with slowing economic data from the US, the Chinese crisis makes an interest rate hike in America, previously anticipated for September, now unlikely to take place this year.

Euro gains as a result of economic concerns elsewhere saw Sterling lose 7 cents against the euro in just five trading days - the sharpest decline since 2009.

Outlook

Despite positive comments from Bank of England MPC members, David Miles, who stated, “Turning points on rates is coming pretty soon”, and Kristin Forbes, who explained that “Waiting too long to raise interest rates could damage Britain’s economic recovery”, the unexpected economic crisis in China led to some economists forecasting that the Bank of England will not hike interest rates before 2017. If accurate, this could weigh heavy on Sterling throughout 2016.

Elsewhere, the Bank of England’s quarterly inflation report indicated a more gradual increase in the rate of inflation than originally anticipated, further reducing the prospect of an interest rate hike in the near future for the UK.

Economic data from the eurozone remains mixed and the growing concern that the economic crisis in China could prove detrimental to the euro as China is Europe’s second largest trading partner.

August finally witnessed positive economic data from Greece. The announcement that Q2.2015 saw economic growth in Greece, which was in fact greater than the UK’s Q2 figures, undoubtedly boosted the euro.

However, any positivity was short-lived as it was announced that Greek Prime Minister Alexis Tsipras had resigned and that snap elections will follow - currently expected 20th September. Whilst departing Prime Minister Tsipras clearly did what was necessary to remain in the eurozone, MPs believe the terms agreed were detrimental to Greece and have lost confidence in their leader, adding to uncertainty developing once more around Greece. Any financial reforms are delayed as an interim government will not have required a mandate to make such political decisions.

In passing the Greek bailout agreement Chancellor Angela Merkel experienced her largest ever parliamentary rebellion with 63 members of her own party voting against her. This suggests any further financial aid is extremely unlikely, and given Greek creditors believe Greek debt will hit 200% of GDP (Gross Domestic Production) in 2016, further uncertainty and threats of a Grexit could weigh heavily on the euro going into the New Year.

This point was illustrated by comments from former Greek Finance Minister, Yanis Varoufakis, who believes, “Greece bailout will not work as it is founded upon unsustainable debt”, and emphasised by analysts’ forecasts which predict the Greek economy will experience an overall contraction of -2.7% as opposed to forecasts of 2.3% growth, used when finalising the bailout.

Meanwhile, confidence in the euro was further damaged by the announcement that Poland and the Czech Republic will not be joining the eurozone, with the Governor of Poland likening the option of joining the euro to, “running into a burning building”.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: French Property Cooling Off Period

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.