Sterling Volatility Continues Amid Referendum Uncertainty

Tuesday 03 May 2016

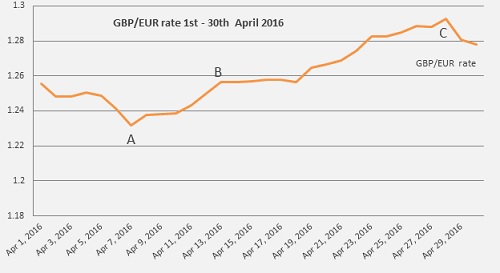

April proved to be another volatile month for euro buyers as sterling tested the lowest levels for nearly two years against the euro before recovering during the second half of the month, says Ben Scott.

Sterling started the month on the back foot, as has been the case in recent months, following further uninspiring economic data, against the political uncertainty gripping the UK ahead of the EU referendum.

Speculation surrounding potential ramifications of a Brexit weighed heavily on the pound with an ICM online survey at the start of the month indicating both the ‘Remain’ and ‘Leave’ campaigns were neck and neck.

GBP/EUR traded at a low of 1.2317(Interbank) on 7 April 2016, and despite trading at an average rate of just 1.2613 throughout April, sterling was able to regain some losses towards the end of the month. This was more due to warnings from US President, Barack Obama, who added his voice to the campaign for the UK to remain part of the EU, which lead to a GBP/EUR high of 1.2927.

As has been the case in recent months, economic data remains mixed in both the UK and eurozone, but in a clear blow for Chancellor George Osborne, and significantly contributing to sterling weakness leading to point A on the graph, was an announcement that UK productivity was down a huge 1.2% in the three months to December 2015.

With the Office for National Statistics revealing that this collapse in productivity was the worst reading since the end of the financial crisis 2008, the concerns surrounding weak growth and uncertainty surrounding the UK referendum could see sterling under huge pressure in coming months.

A statement from the International Monetary Fund (IMF) that the “UK’s exit from the European Union could cause severe regional and global damage”, cooled sterling’s recovery during the middle of the month, but these claims were quickly rubbished by the ‘Vote leave’ campaign, who said that “the IMF have been consistently wrong in past forecasts”. This, again, highlights the confused information and uncertainty surrounding the referendum which continues to weigh so heavily on the pound.

Sterling’s push higher against the euro towards the end of the month, and point C on the graph, was significantly boosted as a result of comments from US President Obama who warned the UK would be “at the back of the queue” for a trade deal with America were we to vote for leave the EU. This combined with strongly worded advice from eight former US Treasury secretaries, who collectively stated that “Leaving the European Union would be a risky bet for the UK”, and that it could “threaten London’s pre-eminence as a financial capital”, saw sterling surge as support seemed to increase for the campaign to remain in the EU.

However, the slight downturn in sterling fortunes towards the end of the month can be attributed to a recovery in the ‘Leave’ party’s campaign which seemed to be floundering after London Mayor, Boris Johnson, was criticised after claiming President Obama’s “part Kenyan ancestry had resulted in anti-British sentiment”, implying this was behind his stance on the UK potentially leaving the European Union.

Any Brexit campaign blips were quickly forgotten, however, after a speech from prominent ‘Leave’ campaigner Michael Gove. He warned the UK will face a future migration “free for all”, with EU membership discussions for Macedonia, Montenegro, Serbia, Albania and Turkey ongoing.

Outlook

Whilst it is of concern that a trade agreement could take up to 10 years to be agreed between the US and UK, it should be recognised that the EU–US fair trade agreement or TTIP (Transatlantic Trade and Investment Partnership) has been years in the making, and given ongoing opposition from several powerful countries, including Germany, it seems a long way from completion. The UK would be able to continue trading with the US as it currently does.

Combine these comments with President Obama’s that a vote for the UK to leave the EU would not negatively impact any existing security agreements, the case for a ‘vote to leave’ gained traction, which will lead to further uncertainty and weigh on sterling up to the referendum.

Elsewhere, comments from the Bank of England’s Monetary Policy Committee member Dr Gertjan Vlieghen, in April, that the “Bank of England would have to carefully weigh negative rate impact”, suggests that a potential interest rate cut from the BoE is not out of the question. This could weigh on the value of sterling, but given a recent up-tick in inflation, it certainly seems the next rate movement from the BoE will be to raise interest rates not cut them. However, any movement this year remains extremely unlikely.

Despite comments from European Central Bank member Coeure that a “timely solution is in sight for Greece”, similar rhetoric has been heard in recent months, without any real positive outcome, and suggests the Greek debt crisis remains a significant concern, which could detrimentally impact the euro in the coming months.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: Tax Breaks for Business Accounting

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.