Sterling/Euro Currency Review April 2015

Tuesday 05 May 2015

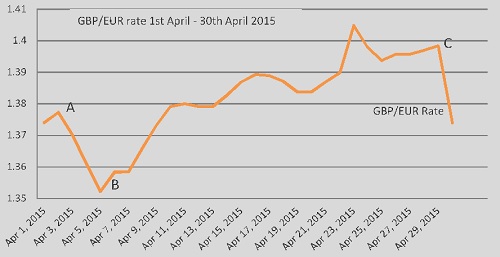

Sterling gained against the euro throughout the majority of April despite sharp drops at both the beginning and end of the month, says Ben Scott.

Sterling struggled to break significantly higher as uncertainty grew over the outcome of UK elections on 7 May 2015, with polls failing to predict a clear outcome.

Meanwhile the euro was once more under significant pressure as fears of a ‘Grexit’ once more gripped the market.

Greek officials again failed to agree a deal regarding Greece’s significant debt obligations leading a Goldman Sachs strategist to state in the Wall Street Journal, “The risk of Greece exiting the Eurozone is rising sharply”, as is the threat of unprecedented shock to Europe’s Monetary Union.

Sterling started April in positive fashion as illustrated by point A as revised growth forecasts beat expectations for the final quarter of 2014 indicating the UK economy grew faster than expected in the final quarter of 2014. Manufacturing, construction and service PMI data released in early April show continued growth in these sectors.

Further, sterling was boosted by comments from respected investment bank Goldman Sachs who claimed, “Rate cuts are almost off the table”. However, with inflation remaining at record lows of 0% the potential for any interest rate increase in the UK in 2015 has almost completely been removed, potentially making sterling a far less attractive investment going forward.

Comments from European Central Bank (ECB) member, Peter Praet, supported the view that economic data from the Eurozone is improving. Praet stated the Eurozone seems to be “turning a corner”, before claiming, “[the] economy will gain momentum this year”, nevertheless the euro remained under considerable pressure throughout April.

A boost for sterling came on 22 April 22 with the release of the Bank of England (BOE) minutes from the Monetary Policy Committee (MPC) meeting at the start of April. All members of the MPC (which sets the interest rates for the UK on a monthly basis), were unanimous in their vote to keep interest rates on hold, removing concerns that votes could be made for an interest rate cut to deal with the threat of deflation, the UK inflation figures coming in at 0% for last two months running.

Sterling was further supported by accompanying comments from BOE Governor, Mark Carney, who said that he “believes the next interest rate move for the UK will be a rise”. However, as has been the case with UK economic data in recent months, positive data is regularly followed by negative data and any sterling gains were quickly reversed on the release of extremely disappointing headline retail sales figures for March. Figures showed retail sales figures came in -0.5% against an expected +0.4% month-on-month improvement, adding to concerns that the UK economic recovery is running out of steam.

The announcement that the rate of economic growth in the UK halved in the first three months of the year, to just 0.3% in this period, provided the catalyst for sterling’s weakness from point C. This weakness could well be exacerbated in the run up to the UK general election.

Outlook

Whilst sterling continues to show economic growth, although at a slower rate than anticipated, euro buyers will be concerned by the growing belief that sterling looks set to lose regardless of who wins the upcoming election.

A Labour and SNP coalition is widely regarded as being potentially negative for business, with Ed Miliband apparently lacking the support and trust of business leaders. If Ed Miliband were to be elected there are already forecasts of higher levels of borrowing under a Labour government which would prove negative for the pound.

Meanwhile, any Conservative-led coalition, which leaves David Cameron as Prime Minister, will come with a promise of an ‘In/Out’ referendum on Europe by 2017, which would create significant uncertainty and almost certainly would lead to sterling weakness.

Greece remains the immediate threat to the stability of the euro.

Despite Greece meeting a deadline to repay a debt of €460million to the International Monetary Fund (IMF) early in April, a further payment due on May 12th looks extremely unlikely with Greece once more desperate for funding. This desperation raises concerns that Greece may be forced to seek financial aid from either China or Russia, the terms of any such financial aid is likely to weigh on the euro with concerns emerging that such a creditor could have influence on European policy.

Comments from Eurogroup President, Jeroen Dijsselbloem, that a “Grexit was not an option” and “[that] it is in the interests of all concerned to prevent this” shows the appetite to prevent a Greek exit remains.

However, some commentators believe the warning of an imminent default could be a very dangerous tactic from Greece to negotiate more favourable terms with creditors for the repayment of its bailout.

Despite a second positive meeting between German Chancellor Angela Merkel and Greek Prime Minister Alexis Tsipras any agreement could still be a long way away.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: Second Homes Tax Exemption

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.