Sterling/Euro Currency Review Q2 2011

Tuesday 19 July 2011

Sterling performed disappointingly against the euro throughout the second quarter, but over the medium term the Euro could still collapse.

Despite adjustments higher due to concerns surrounding the euro in this period, significant negative pressure forced Sterling appreciably lower, breaching major support levels and reaching the lowest trading levels in over 12 months.

Sterling gets a pounding

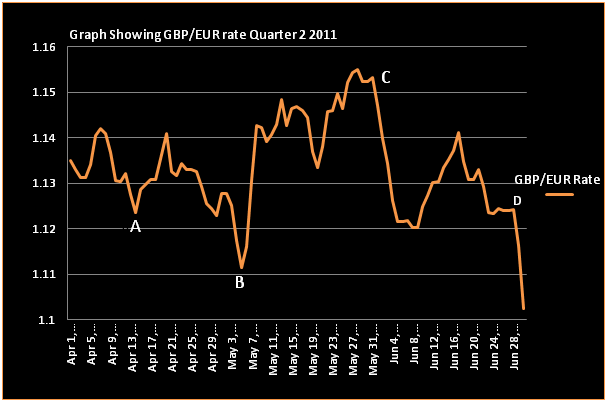

Sterling slipped from a high of 1.1555 (Interbank) at the end of May to a low of 1.1025 (Interbank) by the end of June, representing the lowest trading level for GBP/EUR since March 2010. It is the significant losses and ongoing downward trends towards the end of June that would have caused the greatest concern for euro buyers, as illustrated on the graph below.

Broadly speaking, the GBP/EUR rate dropped by over 5 cents in Q.2 2011 and by 14 cents when compared to the previous year.

Q2 of 2011 started as Q1 had ended, with Sterling’s fortunes against the Euro being dictated by conflicting interest rate policies between the Bank of England (BOE) and European Central Bank (ECB).

The Euro rally against Sterling in the first half of April continued against the negative backdrop of a €78 billion bailout for Portugal, who finally admitted being unable to service its debts without financial aid, similar to that previously required by Greece and Ireland.

Despite it being widely accepted that any such bailout ought to have a negative effect on the currency of that country (in this case the Euro ), a surprise drop in UK inflation from 4.4% to 4% provided clear evidence that the pressure on the BOE to raise rates had abated, preventing Euro weakness against Sterling.

Less pressure on the BOE to raise interest rates, combined with the ECB raising interest rates for the first time since July 2008, from 1% to 1.25% as expected in early April saw the Euro become a far more attractive investment opportunity for investors, with expectations of further interest rate hikes in the Eurozone to follow, allowing the Euro to continue strengthening against Sterling.

The sharp, but short, rise in the GBP/EUR exchange rate, after point A on the graph, was a result of Euro weakness following growing concerns that Greece was losing the battle against its spiralling borrowing costs. This lead to investor concerns that Greece would be forced to enter debt restructuring negotiations, and seek further financial aid on top of the €110 billion bailout package provided in May 2010 or default on its debt entirely. However, any Sterling strength was short lived as speculation grew that the UK would not see any interest rate increases before early 2012, despite previous forecasts indicating rate increases were to take place as early as May 2011.

The pattern of Sterling weakness was quickly re-established and continued for the rest of April as gloomy economic figures pointed to a sluggish economic recovery, resulting in the GBP/EUR rate hitting a 13 month low, breaching significant support levels at 1.1111(0.90, Interbank). Gross Domestic Production (GDP) figures for Q1 2011 in the UK reaffirmed what had been a bleak quarter, with manufacture, construction, retail sales and consumer confidence figures from this period showing the economy had only grown by 0.5%. When taking into account the negative 0.5% GDP figure for the Q.4 of 2010, despite all of the initiatives to stimulate the economy, in real terms the UK economy had stagnated for a full 6 month period.

The sharp increase, immediately after point B on the graph, indicates Euro weakness resulting from sovereign debt concerns. Rumours built from the 6th May onwards that Greece was on the brink of either defaulting on its debt obligations or was set to leave the European Union and single currency completely as it battled to avoid bankruptcy. Excessive borrowing costs meant that Greece would officially run out of cash by mid July without further bailouts. Either option would have had catastrophic effects on the Euro as other peripheral European countries would look to follow suit as a means of dealing with their debt issues, having a negative knock-on effect on German and French economies. These concerns weakened the Euro accordingly, allowing Sterling to almost instantaneously reverse the 3.3% drop seen against the Euro since the beginning of April on the UK’s diminishing expectations for interest rate hikes.

Sterling’s weakness, from point C onwards, can be attributed to increased speculation that the European Union and IMF (International Monetary Fund) stood ready to provide the support and financial aid required to assist Greece through its debt crisis, providing a vital boost to the strength of the euro. Further aid would be provided as a means of protecting the euro and would come in the rumoured form of an additional €110billion financial aid programme, with prominent Euro -group member, Juncker, stating that the “EU were to provide a new aid plan for Greece”.

Simultaneously, Sterling weakened further when continuing, poor economic figures came from the UK, showing a weak economic recovery was compounded by claims from top UK economists attacking the austerity measures and cuts introduced by Chancellor George Osborne and the UK government. These policies had previously been held in high regard within the financial world as a way of dealing with the UK’s crippling budget deficit, but economists were now claiming that “George Osborne’s plan isn’t working (and that the) break neck deficit reduction plan is self-defeating”.

Despite the IMF adding its vital support to the financial policies implemented by George Osborne, talk of further Quantitative Easing (QE) to offset the reduction in the UK’s industrial output weighed heavily on Sterling and lead to credit rating agency, Moody’s, threatening to downgrade the UK’s revered AAA credit rating, further adding to Sterling’s woes.

Bank of England Minutes (22nd June) showed a drop in support for further interest rate hikes amongst the Monetary Policy Committee (MPC), which coincided with the resignation of arch hawk, Andrew Sentance, who had long been an advocate of higher interest rates, and was subsequently replaced by Benjamin Broadbent, who was far less inclined to support the notion of higher interest rates, sending Sterling lower.

Point D on the graph represents even further declines for Sterling follows a catastrophic few days for high street entities in the UK which saw TJ Hughes and Jane Norman slip into administration, whilst HMV, Homeform and Habitat edged ever closer to administration. High street misery was hit with additional distress on 30th June as Lloyds Banking Group announced that a further 15,000 jobs are to be axed (in addition to the 27,500 jobs since its 2009 merger with HBOS) as a result of what Lloyds’ new CEO, Antonio Horta-Osorio, called, “a slow and long recovery for the UK economy”.

This significant weakness in what is a vital sector in the UK economy saw Sterling slip into freefall against the Euro, which strengthened against all of its trading partners after the beleaguered Greek MPs, lead by Papandreou, having survived a vote of no confidence, passed the key austerity vote against a backdrop of extreme civil unrest. This satisfied European Union conditions for further aid, and the release of the next tranche of loans for Greece, allowing it to avoid default on its debt obligations.

Outlook

Going forward, numerous factors will dictate the direction of GBP/EUR exchange rates in the short to medium term, and while indicators suggest the rate will continue in its current downward trend, there is certainly some potential for shocks, which could hit euro strength significantly.

Despite unsustainably high inflation in the UK, and given the weak economic recovery to date, tightening of monetary policy by the BOE looks extremely unlikely, meaning that should the ECB rise rates further (which looks likely as early as July), the exchange rates will deteriorate further. Crucially, if calls for further QE, which has recently been backed by the Bank of England Monetary Policy Committee member Adam Posen, gains traction, then Sterling has significant potential to move drastically lower. Former Bank of England official, Sir John Gieve, cautioned as much, stating “Further fiscal stimulus could also lead to considerable devaluation of the pound, possibly of as much as 20% against its main counterparts”.

On the other hand, despite improving economic fundamentals in the Eurozone, there is a growing concern that credit rating agencies may dictate that the debt relief package offered to Greece, which involved French banks agreeing to roll over Greek debt, actually places Greece in default of its debt obligation. This would prevent the implementation of further aid for Greece and shock the Euro.

Further, of even greater concern to the stability of the Euro is the statement that came at the end of June from the Portuguese Prime Minister, who claimed, “We face deep problems that need urgent solutions”. If this is the start of a second phase of debt crisis for Portugal, similar to that recently seen in Greece, then the Euro could come under serious selling pressure.

Therefore, for all of the obvious concerns currently surrounding Sterling, it seems hard to argue that the Euro is anywhere near as stable as recent market movement suggests, and as financial concerns continue to engulf the Eurozone, the Euro is in no way out of danger of collapsing in the medium term.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.