Sterling/Euro Exchange Rate Review March 2019

Tuesday 09 April 2019

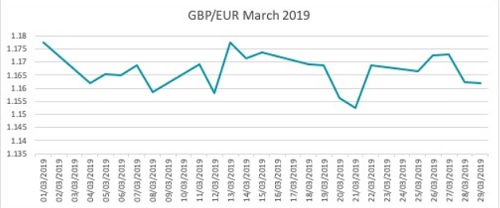

The Pound to Euro exchange rate trended largely sideways in March, as the clock counted down to Brexit day, writes Ben Scott of Global Reach.

Pound hits highs while data registers lows

The end of February and early March saw the Pound hit two-year highs against the Euro, and seven-month highs against the US Dollar as Brexit developments unfolded.

The British currency was buoyed when Jeremy Corbyn backed a second referendum, and the possibility of an Article 50 extension came to light.

However, economic data at the start of March didn’t paint a pretty picture of the British economy. The UK construction sector entered contraction in February and increased the likelihood of a recession in the sector in Q1.

The early days of April have shown the sector is still struggling and stagnating with weak figures attributed to Brexit uncertainty, which has seen businesses less committal when it comes to new projects.

Economist Rebecca Larkin stated: ‘The climate of uncertainty has kept the pause button pressed on investments in new office space, particularly the higher-value towers that have driven activity since the recession.’

Central bank dovishness

The Euro weakened to multi-year lows at the start of the month after the European Central Bank (ECB) took a dovish stance on monetary policy and said interest rates would remain low for the rest of the year. The prospect of further monetary stimulus from the central bank to encourage economic growth also weakened the Euro, and subsequent data releases haven’t boded well for EUR strength either.

ECB President Mario Draghi suggested that US President Donald Trump’s trade wars had had a great impact, and that the central bank would be starting a new round of cheap loans to Eurozone banks to spur growth.

The central bank also opted to cut its growth expectations, forecasting only 1.1% growth in the bloc in 2019, down from its previous estimate of 1.7%. The Euro dropped to a three-week low on the news.

Slowing down

Economic data out of the Eurozone in March confirmed fears the currency bloc was in the grips of a slowdown. Factory output for the bloc came in at its lowest level in five years, while the German manufacturing sector shrunk at its quickest pace in six-and-a-half-years. While slowdowns in Germany, Italy, and France may have encouraged the ECB to cut its growth forecasts, Mario Draghi suggested that the bank thought the chances of a recession would be ‘very low’.

Meanwhile, on the 21st March, the Bank of England (BoE) also left interest rates on hold as it attempted to offer the UK economy some protection while Brexit was ongoing. The central bank also stated that 80% of British businesses had prepared themselves from a hard Brexit. However, companies are unable to protect themselves against disrupted supply chains which may be a result of a no-deal scenario and need to prepare for potential currency volatility. At the same time, Sterling was feeling the heat as Theresa May angled for an extension of Article 50 amid speculation that May’s deal would be unlikely to gain the support it needed in parliament.

In positive news, UK consumer spending still seemed to be noting an upswing, with retail sales climbing by 0.4% in February, rather than dropping by -0.4% as expected. Pantheon Chief UK Economist Samuel Tombs said: ‘February’s Retail Sales figures show that the improving trend in real wages, and not the uncertainty created by the Brexit saga, is the dominant influence on households’ spending at present.’

Hitting lows

By the end of March, Brexit had gotten the better of the Pound, which hit three-week lows against the US Dollar and was on target for its worst month since October.

The decline came after MPs voted down Theresa May’s Brexit deal for the third time in a last-ditch attempt. Sterling was pressured lower as the threat of a no-deal Brexit rose, and speculation regarding a longer extension circulated.

GBP/EUR exchange rate forecast

The Pound is likely to be driven mainly by Brexit as developments continue. This week could be especially significant as cross-party talks stall, and there are only days left before the EU’s deadline—Britain is scheduled to leave the union at 11pm on Friday.

While in March the Pound had been this year’s best Group of 10 performer, there’s still a lot of uncertainty which needs to be ironed out before Sterling will be offered any stability.

In the meantime, comments from central banks could also sway the GBP/EUR exchange rate. More dovish comments could put pressure on the Euro, and poor economic data may also create Euro losses. The European Union will also be holding a round of elections soon, which could create political uncertainty in the bloc and be another factor to influence the Euro.

Ben Scott

Global Reach

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.