Sterling Euro Currency Review - March 2013

Thursday 04 April 2013

Sterling rallied on the back of the Cyprus bailout, despite a weak start in the month.

After a dire start to 2013 where Sterling lost over 8% in value against the Euro, it endured further losses going into March, before rallying by the end of the month.

The combination of the loss of the UK's revered AAA credit rating at the end of February and the on-going threat of a triple dip recession weighed heavily on the Pound.

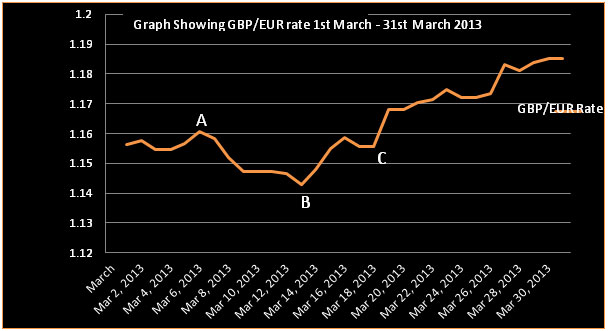

Sterling’s weakness was nevertheless greatly reversed as illustrated by Point C on the graph below as the economic situation in Cyprus reached crisis point, bringing long overdue relief for Euro buyers, as previous comments from European leaders such as European Central Bank President Mario Draghi’s "darkest clouds over the Euro area have lifted now” appeared premature and overly optimistic.

Sterling’s negative start to March saw the currency reach lows of €1.1430 (interbank), before touching a high of €1.1845 as a result of the financial crisis in Cyprus trading at an average rate of €1.16 during March 2013.

The steady decline in the GBP/EUR rate after Point A came despite continued political deadlock in Italy and Euro data released on the 6th March showing that the Eurozone had experienced a significant decline in output means the on-going recession gripping the Euro block shows no signs of abating.

Sterling’s weakness during the same period was a consequence of negative manufacturing data, and activity for the UK's construction sector slowing to the lowest level since autumn 2009, leading credit rating agency Standard & Poor's Mortiz to provide a desolate outlook for the UK economy stating "the UK's situation is not getting any better for the UK economy.”

Sterling made solid gains from Point B on the graph as Bank of England Governor Mervyn King provided his most positive comments since the onset of the financial crisis in 2007, proclaiming “Britain’s economic recovery is in sight and the pound has fallen far enough.”

Further optimism was witnessed when Chancellor George Osborne used the Budget on March 20th to claim the UK would avoid a triple dip recession. Unfortunately, such claims may prove overly optimistic, as predicted by Standard Chartered’s Head of Ecomomies’ Sarah Hewin who stated “the UK will not be able to avoid a triple dip recession.”

Outlook

Numerous factors will determine the direction of GBP/EUR rates with the short term outlook remaining extremely volatile.

Sterling faces prolonged headwinds as illustrated by George Osborne's Budget which suggested that UK debt will peak later and at a higher level than previously forecast, leading credit rating agency Fitch to place the UK Economy on negative watch for a credit downgrade. Fitch’s statement that "Britain's lack of growth and growing debt mountain means there is heightened probability of a downgrade in the near term" suggests it too may follow Standard & Poor’s recent downgrade with its own. Fitch is expected to be confirm its decision by the end of April.

On a more positive note, comments from the Monetary Policy Committee over the "unwarranted depreciation of Sterling” increased hopes that Sterling would recover further after a dreadful start to 2013.

Whilst the Eurozone continues to battle slow economic growth and political uncertainty, concerns surrounding the restructuring of Cyprus’ banking system announced on 25th March, which Russian Prime Minister Dmitry Medvedev claimed amounted to “continued stealing” will continue to weigh on the Euro.

The issue for the Euro going forward is that the Cyprus bank restructuring agreement, which will see Laiki Bank being wound down and significant levies applied to private individuals accounts, could be a template for the rest of the Eurozone.

Ben Scott

Foreign Exchange Ltd

www.fcexchange.co.uk

Next Article: Social Charges and Furnished Lettings of Non-Residents

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.