Sterling/Euro Exchange Rate Review July 2019

Thursday 08 August 2019

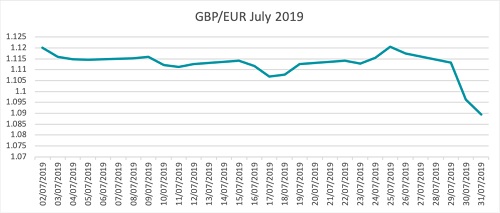

The Pound to Euro exchange rate ranged between interbank levels €1.12 and €1.08 in July as politics directed the British currency, writes currency specialist Ben Scott of Global Reach.

Politics in the Spotlight

July was dominated as to whether a no-deal exit Brexit could or would take place. During the Conservative Party leadership race Boris Johnson kept the possibility firmly on the table, which pressured the Pound.

Meanwhile, the Euro felt the effect of debates over who would be the next European Commission President.

Alongside political events, data showed UK factories had noted their biggest contraction in six years due to Brexit uncertainty.

However, as July continued, UK growth numbers surprised to the upside, allowing the Pound to regain some strength. UK Gross Domestic Product (GDP) growth came in a 0.3% in May, a positive reading following April’s -0.4% contraction. In the three months through May, growth hit 0.3%, higher than the 0.1% forecast. Office for National Statistics head of GDP Rob Kent-Smith commented: ‘The economy returned to growth in the month of May, following the fall seen in April. This was mainly due to the partial recovery in car production.’

The services sector accounts for around 80% of the UK economy and eyes will continue to focus on upcoming data to see what further damage Brexit is causing. Rob Kent-Smith continued: ‘There has been a longer-term slowdown in the often-dominant services sector since summer 2018.’

On the 16th July, the Pound dropped when both Boris Johnson and Jeremy Hunt both opposed the Irish backstop, heightening the chance of a no-deal Brexit. By the end of the week, the Pound had recovered some ground as MPs moved to block a no-deal scenario.

Registering Lows

As July continued, the Pound registered its weakest July reading on record since the Euro was introduced in 1998.

As Boris Johnson became the winner of the Conservative Party leadership race, the Pound soon began to weaken on comments from new Ministers regarding a no-deal Brexit.

Meanwhile, signals from the European Central Bank (ECB) that more stimulus measures could be introduced caused the Euro to soften. ECB President Mario Draghi commented on the worsening global growth outlook, and inflation which is significantly below the bank’s 2.0% target at 1.3%, suggesting ‘the need for a highly accommodatiing stance of monetary policy for a prolonged period of time.’

The promise of more stimulus measures did little to support the Euro, but it was offered in a bid to boost confidence and activity in the export-heavy currency bloc which has felt the impact of slowing global growth. Draghi continued: ‘The bottom line… Is basically we don’t like what we see on the inflation front and symmetry means there is no 2.0% cap. Inflation can deviate on both sides.’

GBP/EUR Outlook

As July came to a close, the Pound continued to soften, hovering just a percent away from 34-year lows against the US Dollar as markets took Johnson’s no-deal threat seriously.

What remains to be seen is how seriously the EU will take the new Prime Minister’s promises to leave on October 31st.

The Euro also hit 26-month lows against the US Dollar by the end of July as the US currency strengthened.

In coming weeks, speculation over whether a vote of no confidence in the government will be seen could cause further Sterling movement, while signals from the ECB of further monetary policy easing could impact the way the Euro trades. Politics is expected to be the main driver for GBP/EUR in coming months, especially as the October 31st deadline draws nearer.

This Friday’s UK GDP reading will also be in particular focus, especially given recent economic data; the beginning of August showed car sales declined for the fifth month in a row in July, the weakest July reading since 2012.

Meanwhile, forecasts suggest British growth could have flat-lined in the three months to June, or even contracted—an event which could mount significant pressure on the Pound, and the government to find a swift conclusion to Brexit.

Ben Scott

Global Reach

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.