Quarterly Sterling/Euro Currency Review - Q1/10

Thursday 15 April 2010

Sterling moved up against the Euro in the last quarter, but the outlook could see it fall back again, writes Nicholas Fullerton.

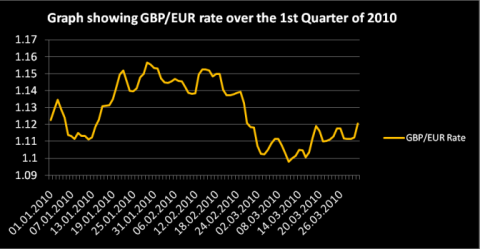

Much the same as the last quarter of 2009, the first quarter of 2010 saw roughly a six cent trading range for the Sterling / Euro currency pair.

The difference, however, was that the average GBP/EUR exchange rate for Q4 of 2009 was 1.1057, while it was 1.1273 for the Q1 of 2010, an average increase of around 2 cents.

The increase was mainly attributable to concerns about sovereign debt within the Europe. The debt situation in Greece spooked the market, igniting similar fears about other nations such as Portugal, Ireland and Spain. This weakened the Euro. The lack of immediate support for Greece from France and Germany knocked confidence in the single currency, as it was shown to be somewhat fractious.

In addition to Euro weakness (good for Euro buyers and bad for sellers) we also witnessed some strength from the Sterling side. As can be clearly seen on the graph below, the pound made gains around the 8th of January. This was due to news that the Bank of England intended to end its ‘quantitative easing’ package. The markets read this as positive, it seemed the UK economy had been sufficiently stimulated and the pound was backed.

Conversely a sharp drop in the value of Sterling occurred around the 24th February when GBP/EUR was sitting at 1.1388. Dovish comments from the Bank of England’s Monetary Policy Committee sparked an air of caution and the pound was sold off.

The future...............

Two main factors could see Sterling weaken across the board during the second quarter of 2010.

The first is the UK general election on 6th May. The pound has already suffered amidst concerns there may be a hung parliament. Should this be the case (which some polls indicate is a distinct possibility), there are concerns that no credible economic plan could be formulated and executed to resolve the deficit situation in the UK. Britain may have its AAA credit status down-graded and the pound would weaken.

The second factor is the quantitative easing program. Sterling has reaped the rewards of increased market confidence as a result of the package. However, the withdrawal of such unprecedented stimulus will be a problem that any new government will have to face.

The quandary in basic terms is this: leave the measures in place too long and a key risk is inflation. A basic tool to combat inflation is an interest rate hike – but this could stifle the UK economy, which still remains fragile. However, the measures need to remain in place long enough and not be withdrawn too sharply, otherwise confidence restored to date may falter.

Nicholas Fullerton,

Foreign Exchange Ltd

www.fcexchange.co.uk

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.