Quarterly Currency Review - Q3 2009

Tuesday 03 November 2009

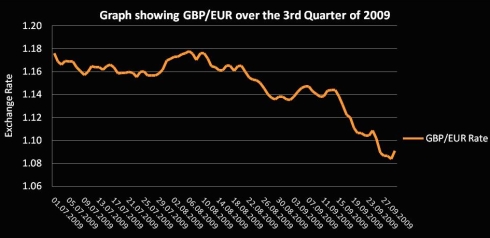

Sterling suffered badly against the Euro in the third quarter, moving almost ten cents from the heady €1.17 levels to around €1.08, writes Nicholas Fullerton.

Sterling lost ground at the beginning of July due to poor Gross Domestic Product (GDP) figures, and for the remainder of the month trading was fairly ‘range bound’, i.e. no massive rate fluctuations.

However, at the beginning of August the Bank of England increased their Quantitative Easing (QE) program by £50bn. The program was designed to stimulate growth in the UK economy, and such a big increase worried the currency markets. This had a negative effect on Sterling as can be seen by the drop on the graph at the start of August.

There is a second sharp drop mid way through August when the minutes from the Bank of England's August meeting were released. These showed that some members (including Mervyn King – Governor of The Bank of England) actually voted for the £50bn stimulus figure to be even higher, at £75bn. This rocked the market and Sterling traded lower on the back of negative sentiment.

GBP recovered slightly towards the end of August as better than anticipated growth figures were reported.

However on the 15th September the sharpest fall on the graph occurs when Mervyn King indicated that he may reduce the interest rate on bank reserves and warned of a long slow road of economic recovery ahead. His comments weighed heavily on the British Pound and the Euro posted gains (going from €1.14 to around €1.050) over the course of the following few days.

If you are a Brit looking to buy a French property the Euro exchange rate falls in the quarter have severely decreased your purchasing power. At GBP/EUR €1.17, a €350,000 house is just over £299,000, but at a rate of GBP/EUR 1.08 the same property costs and extra £25,000, a difference that really brings into focus the impact an exchange rate can have on a budget.

Some comfort can be taken from the fact French property prices have also dipped by 10% to 20% over the past two years. If you are selling a French property now would seem an ideal time to repatriate funds.

Nobody knows what the future holds for Sterling. However, the UK was officially in recession through the third quarter of this year, as figures showed the economy shrank between June and September. It is the sixth successive quarter of contraction and leaves the UK in the grip of the longest period of continuous decline since 1955.

Many predict the UK will emerge from recession during the next quarter. If that happens it will almost definitely help Sterling claw back some lost ground.

Nicholas Fullerton

Foreign Exchange Ltd

www.fcexchange.co.uk

*All rates mentioned are Interbank prices.

Related Article: Quarterly Currency Report of April/June 2009

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.