House Prices in France 2020

Wednesday 10 February 2021

Early reports suggest strong resilience of the French housing market last year against the backdrop of Covid, although bets are off for 2021.

Last month, several commentators in France published their separate analyses of the housing market.

There are short reviews of the year from national estate agents ERA Immobilier, Century 21, and Laforêt, as well as the national association of estate agents FNAIM, and the on-line observatories of LPI-SeLoger and MeilleursAgents.com.

Although a useful guide to the performance of the market, the statistics provided are a bit like wine tasting: they are samples, from which extrapolations need to be made. None of the commentators have a complete picture, with the branch network of the chains concentrated mainly in the towns and cities, and the observatories similarly only able to obtain access to a sample of the translations from their partner agents

Moreover, as around 40% of properties are sold privately, a substantial number of sales cannot be measured by either the agents or the observatories.

Nevertheless, despite the shortcomings, the synthesis provided by the agents is interesting, because they show a trend. So what do the latest reviews say?

Sales

After two exceptional years for the real estate market in 2018 and 2019, 2020 has been severely disrupted by the unprecedented economic and health crisis.

FNAIM estimate that the number of sales will be 980,000, a decrease of about -8% compared to 2019, but still up on 2017 and 2018.

Although the notaires have yet to report on the year, based on third-quarter figures they project sales of slightly over 1 million, a fall of only -4% from 2019.

Given the crisis, when France was in lockdown for nearly two months, that remains a surprisingly high number, which the estate agents and notaires attribute to a catch-up phenomenon following the first lockdown.

Jean-Marc Torrollion, President of FNAIM, stated that: "In these troubled times, real estate is confirmed as a safe haven for the French. Despite the confinements and the uncertain economic situation, property appears as a reliable and sustainable investment." The notaires also consider it "un marché d’utilisateurs sain et solide."

Sales to non-residents are inevitably down, reaching their lowest point in 10 years, with highest falls in Paris. Most non-resident buyers preferred to buy in the countryside.

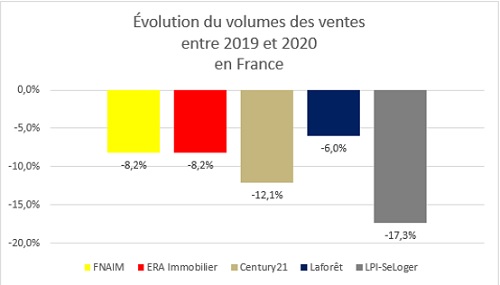

As can be seen from the graphic below, LPI-Seloger consider the fall in sales was substantially higher, but this may be attributed to the urban bias of their market. In Paris, for instance, sales fell by -17%, which was mirrored to a lesser extent in the wider Ile-de-France.

Prices

Contrary to early expectations, prices of all types of property rose in the year, between +2.1% and +5.5%. Only FNAIM and Century 21 offer separate figures for houses and apartments, with FNAIM saying house prices rose by +2.4% and apartments +5.3%, whilst for Century 21 prices rose +4.1% and +1.2% respectively. Orpi, another national chain, report an average national price increase of +2% in the year, but +1% in Paris. The general level of Inflation in the year was +0.5%.

Michel Mouillart, Professor of Economics at the University of Paris Ouest and spokeman for the Baromètre des prix immobiliers LPI-SeLoger stated: "The increase in the price of existing housing did not weaken in 2020. In most cities, it even reinforced as soon as the first confinement ended. But with the second containment, buyers began to seriously question the merits of real estate projects and, almost everywhere, the pace of the increase began to stabilise. However, in the absence of a deteriorating economic situation and rising unemployment, prices rose in 2020 in almost all cities with more than 100,000 inhabitants."

Separately, the notaires, who have yet to fully report for the year, consider that prices rose around +5% in the year (based on third quarter figures), with a slightly more pronounced increase for houses than for apartments, especially in Ile-de-France where the health crisis seems to have accelerated the aspirations to move away from the capital to be able to enjoy a property with a garden.

At a national level FNAIM state that the price average per square metre was €2,276 (+2.4%) for houses and €3,844 (+5.3%) for apartments, although with huge variations by geographic area - over €10,000m2 in Paris and around €1,000m2 in some departments. ERA Immo state that the average transaction value rose from €222K in 2019 to €232K in 2020, an increase of +4.7%.

Analysts attribute the increase in prices to low interest rates and a shortage of property on the market due to Covid. In a recent survey carried out by Seloger, only 34% of those questioned considered it was a good time to sell property.

All major cities in France were up last year. For apartments, Lyon has become the second most expensive big city after Paris, now ahead of Nice and Bordeaux where the price landing is confirmed.

In the provinces, it is mainly the West that displays the strongest growth. In Rennes and Nantes apartment prices jumped by more than +10% after already strong increases in 2019. For the first time, the price increase of apartments is higher in the provinces than in the Ile-de-France.

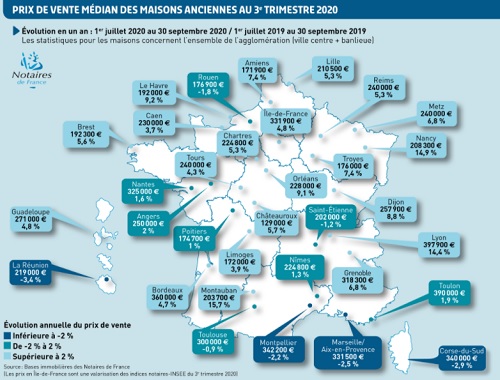

The agents provide no significant geographic analysis, but some information on the third quarter for houses in the major conurbations is provided by the notaires.

As can be seen, prices have fallen in several major cities and towns, notably Marseille and Montpellier.

Although the figures for Paris are not given, recent reports indicate that prices are also falling in the capital. MeilleursAgents state: "The coronavirus crisis may have slightly changed buyers' view of the attractions of Parisian life. Cultural life at half mast, bars and restaurants closed, reduced transport facilities: the immediate interest in living within the city is less obvious than it was a few months ago. Not to mention the deployment of teleworking, which is leading many buyers to wonder about the opportunity, for the same budget, to have an additional room that can be converted into an office."

Despite a lot of talk of an 'urban exodus' the notaires consider that it is not entirely evident, although they acknowledge that the share of buyers coming from Ile-de-France were up in Normandy, the Loire Valley and Burgundy-Franche-Comté.

Nevertheless, small towns and rural areas appear to be increasing in attractiveness, although it is slow to translate into price increases. "This time, it is worth noting some rebalancing has started. The countryside and small towns have begun to stem their decline," says Jean-Marc Torrollion of FNAIM.

Outlook

Neither the agents nor the notaires are willing to make any forecasts for 2021, but stress that the real estate market could not remain insensitive to the economic crisis. There is concern, in particular, that banks appear to have tightened access to mortgages, with many agents saying they have noted an increase in refusals in the year.

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.