House Prices in France for 2011/12

Tuesday 01 May 2012

Despite a record year for property sales in France in 2011 it was a contrasting picture on house prices, and there are clear signs of a slowdown in 2012.

According to a French notaires, who recently published their review of the property market for 2011, some 858,000 sales were registered in France last year, an increase of 9% over 2010, and the highest number of sales recorded in a single year.

The notaires attribute this exceptional level of activity to changes in capital gains tax, which became effective from February 2012, precipitating the sale of a large number of second homes (amongst French owners as much as international owners).

This may well explain why sales in the regions increased by an average of 14%, while those in the Ile de France actually went down by 8%. The highest increase in sales occured in Tarn (31%), Corrèze (+28%) and the Pyrénées-Atlantiques (+24%).

In addition to the tax changes, the notaires consider that abolition of State sponsored interest free mortgages (prêt à taux zéro) on existing property from 2012 pushed a large number first time buyers into acquiring a property. There were nearly 300,000 such sales in 2011.

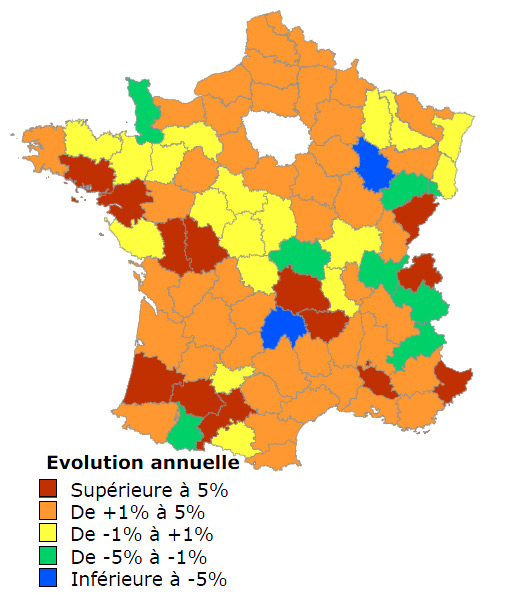

The average increase in house prices in 2011 was 2.1%, but this national figure includes strong growth of around 6% in the Ile de France. When this is stripped out of the analyses, then the average increase over the rest of the country was 1.3%.

Even here there was a great deal of variation between the different departments of the country. While prices rose in most departments, in 8 they actually decreased. Largest falls greater than -5% were in Cantal (Limousin) and Haut-Marne (Champagne-Ardenne).

Strongest price growth occurred in the major towns and cities - Paris (14.7%), Rennes (9.4%), Bordeaux (8.7%), Nantes (8.7%), Toulouse (8.0%), Toulon (7.6%) and Nice (7.5%).

The following image shows the average change in prices in 2011 by department of France.

Source: PERVAL/Notaires de France

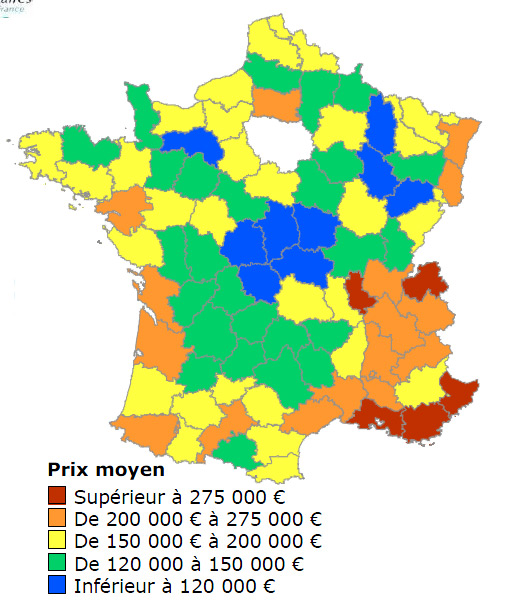

The impact on average prices for houses in each department of France, excluding the Ile de France is shown on the table below.

While it is dangerous to make too many generalisations, it will be seen that the cheapest average prices are to be found in the departments of Orne (Lower Normandy), Cher and Indre (Centre), Nievre (Burgundy), Allier (Auvergne), Creuse (Limousin), Meuse (Lorraine), Haute-Marne (Champagne Ardenne) and Haute-Saône (Franche-Comté)

Not surprisingly, the most expensive properties are to be found along the Mediterranean coast in Provence Côtes d'Azur, in the mountain ski-resorts of Haute-Savoie, as well as in the Rhône department, around its capital city Lyon, in the Rhône-Alps region.

Source: PERVAL/Notaires de France

Outlook

It is rare for property professionals and housing economists in France to agree on their prognostics, but for once there does seem to be a general consensus that both sales and prices will fall this year.

The only question seems to be just what the scale of the downturn will be, on which there seems to be less agreement.

Perhaps not surprisingly the estate agents take the more optimistic stance. The large national chain Century 21 consider that prices will only fall marginally as demand remains strong; FNAIM, the association of estate agents forecast falls averaging 5%.

By contrast, in their latest forecast the notaires seemed to have become gloomier, believing that prices will fall this year by up 10%.

The economists also take a mixed view, with Standard and Poor's notably saying prices will fall 15% by the end of 2013. A similar view is expressed by Credit Agricole, who consider house prices are substantially overvalued, and that the fall this year will be around 6% for older property, with a similar fall into 2013, and with little prospect of any recovery for several years.

Conversely, Xerfi consider that with 300,000 new households in France each year, the impact of the downturn will be contained to around 2.6% in 2012, although in some areas it will be greater. They talk of 'l'adustment, pas de krach'.

In the current economic climate it is not difficult to take the line of least resistance and to think that there could be a general collapse. However, to date the more apocalyptic forecasts from some economists have owed more to astrology than to analyses, so wrong have they been.

Early reports from agents and notaires certainly indicate a slowdown in sales and prices is happening, accompanied by a spectacular (40%) fall in the number of mortgages that have been granted, as banks tighten their lending criteria.

The fiscal changes that have occurred in the past year, such as toughening of capital gains tax, the increases in social charges, and the reduction in tax breaks, are also likely to mean that investment property could be hit quite badly in 2012.

However, while it is unquestionably a buyer's market, such is the diverse nature of the French housing market that local conditions and different property types will mean there continues to be a wide variety of outcomes.

Much is also likely to depend on the result of the French presidential elections, for if the more expansionist economic policies of François Hollande seize the day, then the fortunes of the market could change.

Next Article: Capital Gains for Non-EU Residents

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.