Prices in Paris rose by 7.1% in the year to July, and the continuing rise in prices has prompted one analyst to talk of the 'gentrification' of the capital.

According to the Notaires de France the average price of an apartment in Paris has now reached nearly €9,500/m², which is around 2.5 times higher than the second-place city Lyon, and 4 times more expensive than Marseilles.

Rental have similarly soared, to an average of €890 a month for a tiny 35 m² apartment, a figure that is nearly 75% of the net minimum wage. The city is at least twice as expensive as other provincial capitals in France.

Even Parisians are finding it difficult to cope with the increase in prices for buying or for renting. The median net income of a single person living in Paris is about €2,200 a month. At €9,300/per m², an apartment of 35 m² that is equivalent to a purchase price of €325,500, more than 12 years' income. A couple with two children wanting to have 80m² will pay nearly €745,000.

Only two cities in the world outside the French capital have higher prices: Hong Kong and London. According to housing market analysts, Xerfi that makes Paris the least affordable city in continental Europe, if measured against the incomes of its inhabitants.

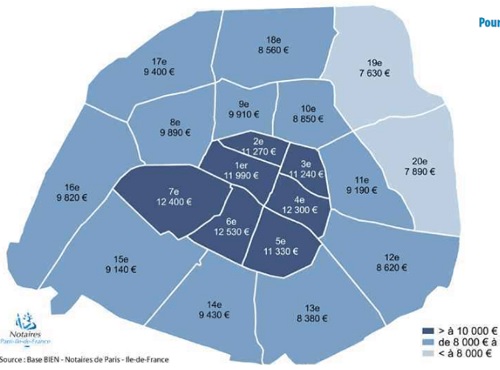

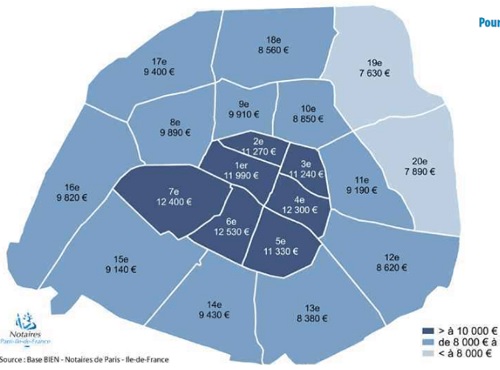

The average prices also disguises significant disparities across the capital. The arrondissements in the centre of Paris are well over €10,000/m², with the 6th the most expensive at €12,530/m² followed by the 7th and 4th also over €12,000/ m². Even that does not tell the full story, for best apartments can reach €20,000+/m²

Prices are cheaper in the north east of Paris in the 19th and 20th arrondissments, but at nearly €8,000/m² the prices are still too high for most households.

Some of the highest price increases are also now concentrated in those districts where prices are lowest, as in the 18th, 19th and 20th districts.

The graphic below shows the average prices for each district as at the end of June 2018.

In fact, the whole of eastern Paris is on the rise, with increases of more than 40% over the last 10 years.

As a result, the ratio between the most and least expensive boroughs has fallen to an 18-year low of 1.6, compared to nearly 2.5 in the early 2000s, causing Xerfi to talk about "la gentrification de la capitale."

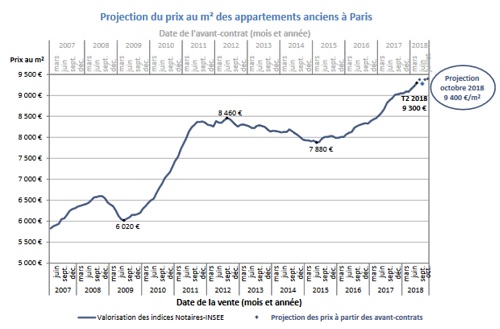

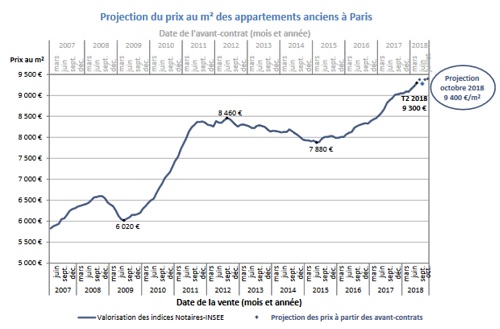

Neither are there signs of any slowdown, with sales contracts signed in recent months showing that average prices have increased since the first half of the year. On the basis of current trends it will not be too long before average prices reach €10,000/m². Prices already exceed this figure in half of the districts.

The notaires forecast that: "La hausse annuelle serait alors moins soutenue qu’il y a un an (8,7 %) mais elle dépasserait tout de même les 6 %."

The graphic below shows average apartment prices in Paris over the past ten years.

The explanation for the increase in prices is not difficult to find. Paris is one of the most attractive cities in the world, the capital city of one of the most attractive countries on the planet.

Other more prosaic factors have fuelled the demand for property, notably the low level of interest rates and an increase in the duration of mortgage finance.

Top-end estate agents have also noticed a Brexit impact on the Paris market, with an increase in sales to those anticipating a relocation from London to Paris following the departure of the UK from the EU.

A significant contributory factor has been the demand from foreign buyers and French nationals seeking an investment property in Paris. National estate agents Century 21 consider that around 25% of purchases in the city are investment related.

Many such properties are let on a short-term basis to tourists and it is not difficult to see why owners want to let on this basis, for the returns are greater, and the risks lower, than renting on a long-term basis to a tenant who occupies the property as their principle home.

The city council is fighting back on the growth of Airbnb type lettings in the city, where

the regulations are now a lot tighter. Enforcement of the law has also resulted in some spectacular fines on some owners. From next year, the platforms will also be required to declare to the tax authority the income earned by their users.

The low-level of new build has not helped in keeping a lid on the market. Local councils in the city have resisted the temptation for building higher, in order to protect the heritage of the city, which has reduced the number of new build apartments that can be built. Last year only 775 new dwellings went on the market for sale.

As a result Parisian companies have great difficulty in recruiting for many sectors, and more households are being forced to live further from the city and commute into work, imposing greater strains on the transport network.