Business Income Tax Relief in Rural France

Friday 04 November 2016

Business start-ups in rural development areas of France can obtain complete exemption from income tax for 5 years.

Established in France since 1996, the Zones de Revitalisation Rurale (ZRR) are areas of the country of low population density or which otherwise suffer structural economic deficiencies.

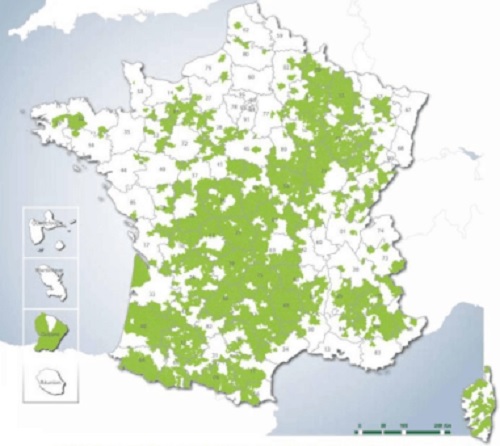

The zonage is widespread, across all corners of France, incorporating around 14,000 of the 36,000 communes, some 6.3 million inhabitants.

Despite the widely-held view that many communes are no longer in need of such favourable treatment, it is a list which has remained largely unchanged since 1996.

As a result, you may well be surprised to find that the area in which you set up your business benefits from this classification.

To find out if your commune is within a ZRR, you can visit the website of L’Observatoire des Territoires, but it might also be prudent to obtain confirmation from your local mairie or tax office. The following graphic shows those areas currently zoned ZRR.

Before you rush to confirm with your local council, the bad news for a great many prospective business owners is that the exemption from income tax does not apply to those who have micro-entrepreneur tax status.

Only if you are planning to run the business either as a sole trader or through a company, in which the business is taxed on the basis of actual profits (régime réel), does the exemption apply. A micro-entrepreneur is taxed on their turnover, not profits, with a fixed allowance for costs.

If you are proposing to adopt the régime réel the relief is not ungenerous, providing:

- Total exemption from income tax for 5 years;

- Exemption at a decreasing rate for the following three years - 75%, 50% and 25% in year 8.

If you operate as a sole trader then the exemption applies to personal income tax (impôt sur le revenu) on business income, and if through a company it applies to company income tax (impôt sur les sociétés).

The overwhelming range of business activities are eligible for relief, except for:

- Financial, banking or insurance activities;

- The management or letting of property;

- Marine fishing;

- Agricultural activities;

- Extension of an existing activity;

- Family successions (although some may gain exemption).

To obtain exemption there are no steps that need be taken; you merely complete (tick) the relevant box on your income tax return. If in any doubt you should obtain prior confirmation from your tax office.

New businesses (including chambres d'hôtes) can also benefit from an exemption from local rates, which we will cover in a future Newsletter.

Next Article: Insurance Against Non-Payment of Rent

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.