Overhaul of French Business Start-Up Procedures

Friday 06 July 2018

Business start-up administrative procedures in France are to be simplified.

A major shake-up of the regulatory framework for business in France has been unveiled by the government.

The plan, called 'PACTE' (Plan d’Action pour la Croissance et la Transformation des Entreprises), is a substantial and ambitious set of proposals, which range from the development of employee savings schemes to the sell-off of French airports.

Of potential interest to expatriates in France are the measures in favour of business creation, both administrative and financial.

Business Centres

One of the central proposals is the abolition of the current network of business creation centres.

At the present time there are seven different business creation centres (Centres de Formalités des entreprises - CFEs), and which one you need to use depends on the type of business you intend to set up and the legal structure.

These centres are:

- Chambres de commerce et d’industrie (CCI)

- Chambres de métiers et de l’artisanat (CMA)

- Chambres d’agriculture

- Greffes de tribunaux de commerce (TC)

- Greffes de tribunaux de grande instance (TGI)

- Services des impôts des entreprises (SIE)

- Chambre nationale de la batellerie artisanale.

It is not always evident which one to use, a feature of the rigid classification of business activities in France into different professional categories, each with their own regulatory framework.

Although the system of business classification will not be replaced, PACTE provides for the gradual implementation by 2021 of a single online platform to replace these seven CFE networks. Whatever your proposed legal status and activity, this single platform will be the only you will need to use.

The Chambres will be kept, and they will remain available for assistance with business creation, but their activities will be re-orientated towards the promotion of exports. They will also be given greater flexibility in their roles, and in their ability to recruit private sector staff (who are currently public officials).

In recent years the funding the centres have received has been substantially reduced, and it is clear that the government would prefer to quietly float them away from a dependence on public resources.

Business Register

Currently there are three different business registers in France, once again depending on your business activity:

- Registre du Commerce et des Sociétés (RCS)

- Répertoire des métiers (RM)

- Registre Actifs Agricole

Artisans are generally registered with both the RCS and RM, which generates additional complexity and costs.

Moreover, the procedures are not harmonised and cannot all be done online.

Consequently, PACTE proposes to gradually introduce, by 2021, a single on-line register centralising the information on companies currently contained in the RCS, the RM and the register of agricultural assets.

All this information will eventually be accessible on a single online platform.

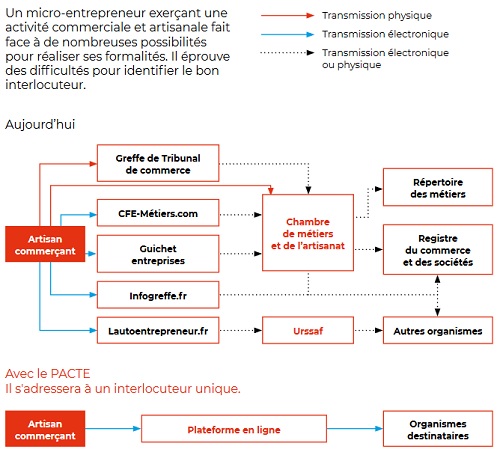

The following graphic shows the current framework of business creation centres and registers for an artisan/commercant and what will replace it.

Legal Notices

According to the government, the average cost for the publication of a legal and judicial announcement relating to the creation of a company amounts on average to €200.

Furthermore, only the printed press is currently authorised to publish these advertisements.

The PACTE bill proposes to authorise online press services to publish these legal notices.

In addition, to reduce the cost of this mandatory advertising, flat-rate pricing will be introduced for advertisements relating to the creation of businesses, but also for other types of advertisements relating to business life, whenever possible. The cost of this advertising will gradually decrease over a period of 5 years.

Those establishing a micro-entreprise are already exempt from the need to publish legal notices; it is restricted to company formation.

Obligatory Training

Currently, those setting up as an artisan are obliged to follow an installation preparation course (Stage de Préparation à l’installation - SPI) before they can start trading.

The cost of this course is €194.

According to the Government, the SPI would cause on average 30 days of delay on the installation of the artisan and the beginning of his activity.

As a result, the PACT bill removes the obligation to complete the course and makes it optional, as is currently the case for all other self-employed workers.

Expatriate business owners are frequently told they must attend this course, when European legislation exempts them from it. You can read more on this point in our Guide to Starting a Micro-Entreprise business below.

Business Bank Account

The obligation for a micro-entrepreneur to hold a separate bank account for their business activities will not apply if their annual turnover is no greater than €5,000.

Currently, there is no obligation to hold a 'compte professionnel' (for which the charges are often quite significant), provided the micro-entrepreneur holds a separate personal bank account for the business.

Other Measures

In related legislation, those micro-entrepreneurs with a turnover no greater than €5,000 will also be exempt from business rates from 2019.

In addition, from 2019 all new businesses (irrespective of legal or tax structure) will be able to benefit from an exemption from social security contributions in their first year, subject to their profit being less than €30,000. There will be partial exoneration up to €40,000 profit. The duration of this measure will be available for up to 3 years for micro-entrepreneurs. We will provide more details in due course, as detailed regulations have yet to be published.

If you seek assistance in with the micro-entrepreneur registration process you can contact us at [email protected]. We are able to offer accompanied telephone assistance with on-line completion of your application for a modest charge.

Thank you for showing an interest in our News section.

Our News section is no longer being published although our catalogue of articles remains in place.

If you found our News useful, please have a look at France Insider, our subscription based News service with in-depth analysis, or our authoritative Guides to France.

If you require advice and assistance with the purchase of French property and moving to France, then take a look at the France Insider Property Clinic.